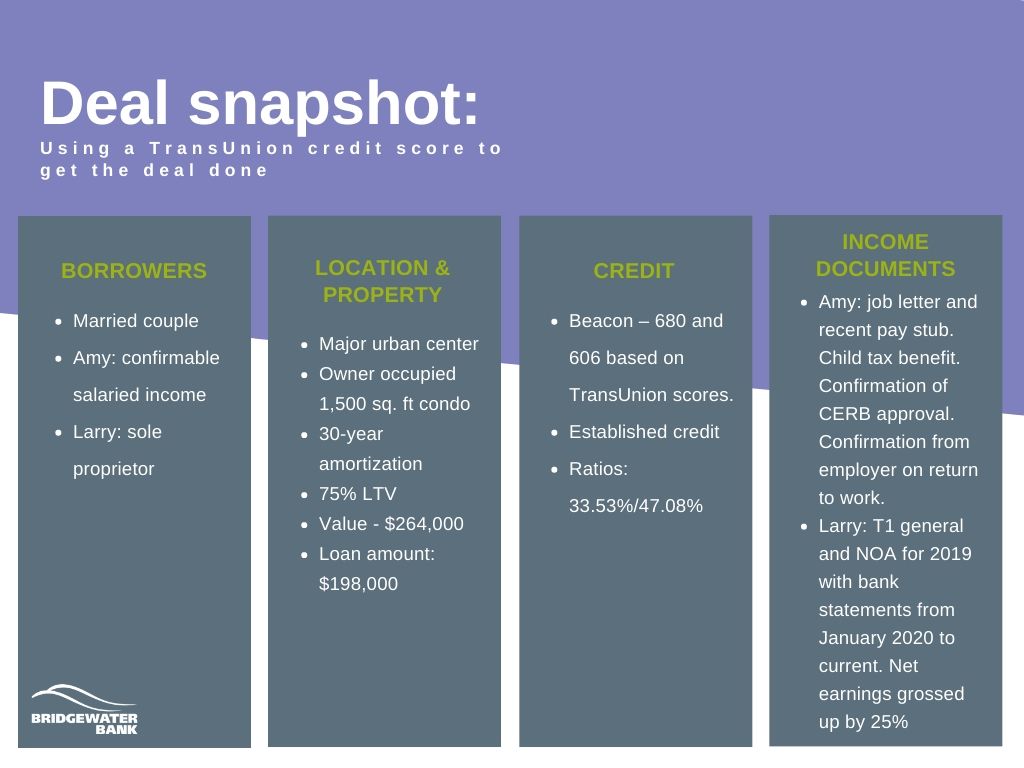

Using a TransUnion credit score to get the deal done

Larry and Amy were recently married and are looking to purchase a home together. Larry is self-employed and Amy is a childcare worker. She’s been with the same company for 13 years and has recently been laid off due to the COVID-19 pandemic. Amy’s employer has guaranteed that she’ll be back to work once the restrictions allow it.

The couple found a lovely condo in a major urban center. Because Amy used her CERB to qualify, their ratios went above what an A lender would accept. Larry and Amy weren’t confident their regular bank would approve their mortgage, so they went to a mortgage broker to help them find a lender.

Solution

Larry and Amy’s broker sent their deal to Bridgewater Bank, she’s had great service from them before and she knew their underwriter would use Larry and Amy’s TransUnion scores over Equifax in this case, to get the deal done and secure them a great rate. Alternative lenders are a safe and trusted option for self-employed borrowers as well as clients with higher ratios.

Bridgewater Bank was able to offer them a one-year term at a fantastic rate. Amy and Larry have a large down payment, good credit, strong docs and an underwriter willing to make the deal work. Once they get their ratios in-line, they’ll be able to renew at an even lower rate with an A lender in the future.

| Term | 1 year |

| Amortization | 30 years |

| Rate | 3.99% |

| Loan amount | $198,000 |

| LTV | 75% |

| GDS/TDS | 33.53%/47.08% |

| Fee | 1% ($1,980) |

| Finders fees paid to broker | 60 bps |

| Turnaround time | Funding: 23 days |