Alternative Lending & Mortgages Explained and How to Reduce Client Concerns

You may notice your clients reacting when they hear they’re being considered for an alternative mortgage. They’re likely worried about the higher interest rates. We’re here to help you put your clients’ minds at ease by explaining the benefits of taking an alternative mortgage and how it can be used as a great, but more temporary, solution.

Alternative mortgages aren’t forever – they are typically used as a stop-gap, a 2-year mortgage term, until clients can improve a few things and renew at a lower rate.

An example of alternative mortgage financing with $65,000 of debt

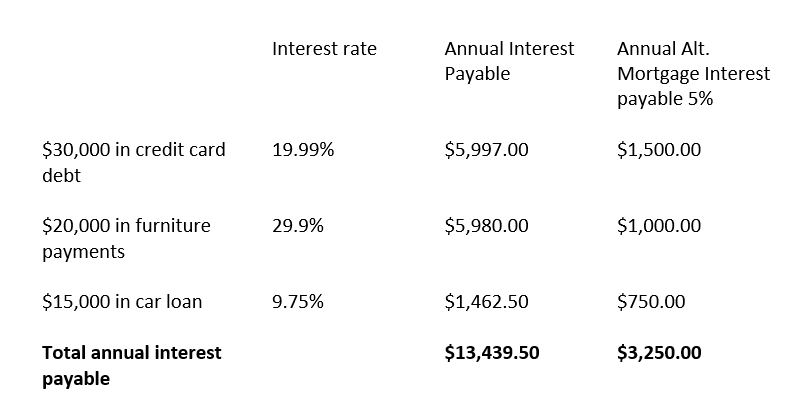

When working with clients to refinance their mortgage to pay off high-interest debts, it is often helpful to break down what they are currently paying in interest. Comparing that amount to what their new alternative mortgage interest would cost gives a compelling illustration of the savings they would enjoy.

Here is an example in which we use a remortgage of an extra $65,000 of debt, comparing typical bruised-credit-score interest rates with a 5% mortgage rate*:

In this example, the clients’ interest savings would be $10,189.50 every year!

* For the purposes of this example, we use interest-only payments to calculate interest payable.

Why Use B Lenders for Mortgages?

Benefits compared to private lenders

It might be helpful to explain to your clients that they are ahead of the game by taking an alternative mortgage compared to those refinancing through private lenders. Private lenders aren’t regulated like banks or credit unions. This means they aren’t required to stress test applicants and therefore are able to qualify those who can’t qualify anywhere else, which also results in much higher interest rates.

Great solution for the self-employed and rental properties

Alternative mortgages shouldn’t bear a stigma of any kind. More and more people are using alternative lenders because of the regulation changes imposed by the government. Alternative mortgages are a perfect fit for those who are self-employed, who own rental properties and for those who have experienced a hiccup or two along the way.

Being knowledgeable will allow your clients to trust you and help them see that taking the alternative avenue is an excellent strategy to succeed in homeownership and financial well-being.

Alternative mortgage funding is a temporary solution

An alternative mortgage is meant to be temporary; it gives your clients time to improve their situation and renew at a better rate in the future. Discussing your clients’ situations honestly and openly will help you discover how invested they are in improving their credit score.

Calculate how long it will probably take them to improve their finances for a mortgage move, and then suggest the most realistic term that suits their situation. Most alternative mortgage terms are for one or two years. Then the mortgage can be renewed with one of the big banks at a lower rate if the clients’ circumstances have changed.

Most alternative mortgage terms are for one or two years.

Be sure to let them know that breaking a mortgage can cost thousands of dollars; take time to decide on the right term-length, so they can have the option to switch lenders and renew with no penalty when the time is right.

Help improve credit score

If you’re working with clients with a low credit score due to a significant life event, sit down with them and go through strategies to improve their credit. Sharing our credit videos with your credit strapped clients will offer them helpful ways get a handle on their finances.

Don’t forget about the self-employed

For your self-employed clients, finding ways in which they can prove their income to renew at a better rate will require a bit more creativity, but it’s doable. Read our gross-ups & add-backs article and share it with your clients.

Take advantage of write-offs and keep an eye on debt-to-income ratios. These can all be helpful in increasing your clients’ income to qualify/renew. And, of course, maintaining a good credit score is essential.

Walking your clients through the positive aspects of their alternative mortgage will calm anxiety and increase trust. Both are key ingredients in forming a successful and lasting relationship.