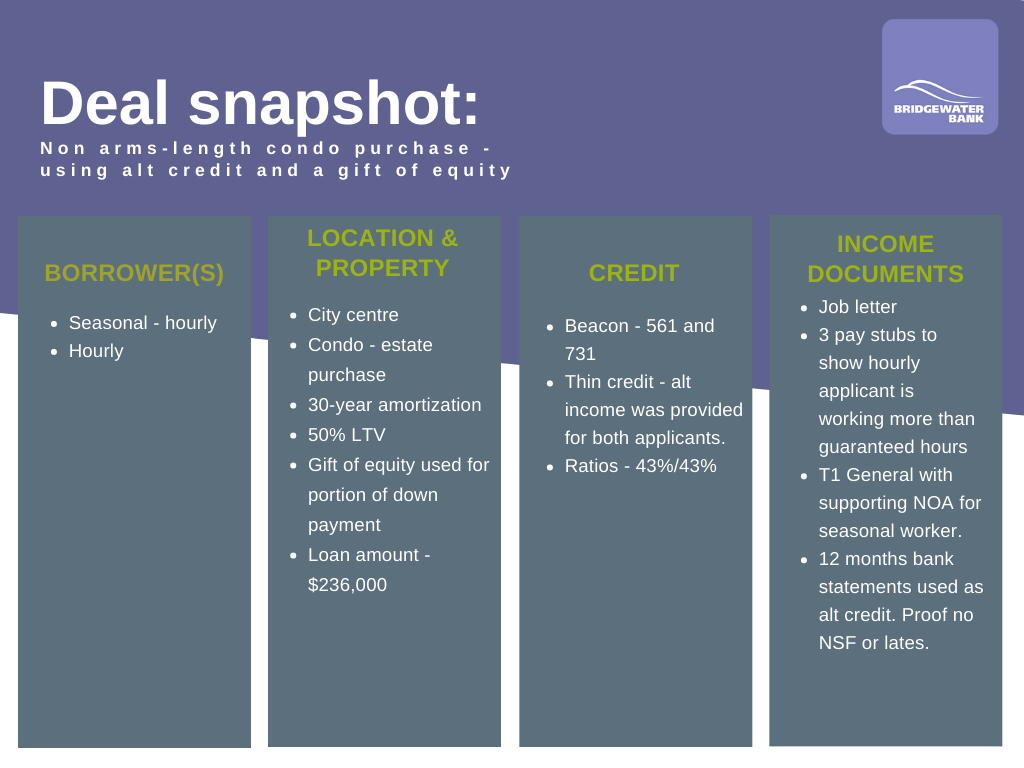

Condo purchase using alt credit and a gift of equity

In this scenario, clients with high ratios and thin credit were able to purchase a condo from a family estate.

As an alternative mortgage expert, our resourceful underwriter found ways to approve this deal at a great rate. First, a gift of equity was used for a portion of the down payment, which brought the LTV to 50%.

Next, the underwriter asked for ‘alt’ credit, which demonstrated that even though their credit was tenuous, these clients had no NSFs, no late payments, and were living within their means. Along with a T1 and NOA to show stable income and no taxes owing – deal approved.

*Commonly two trades for two years are required; in this case, we asked for 12 months of personal bank statements in lieu.

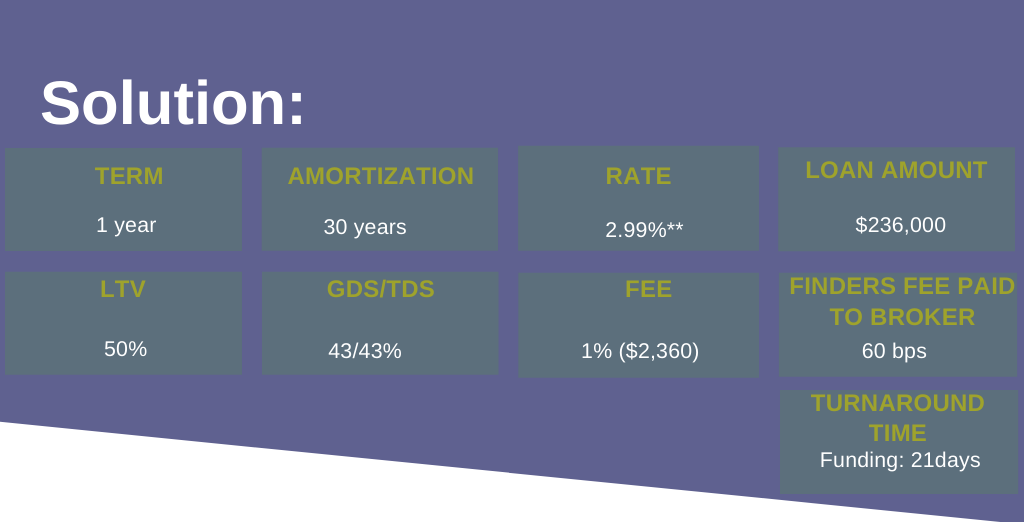

**The AIR is compounded semi-annually, not in advance. The APR based on a $236,000 loan with a 30-year amortization and loan fee of 1% is 4.00%.

All terms and conditions subject to change without notice; see BwBbrokerinfo.ca for details. For internal use only (brokers, agents and affiliates). Not intended for external consumer use.