When an entrepreneur refinances using a gross-up approach.

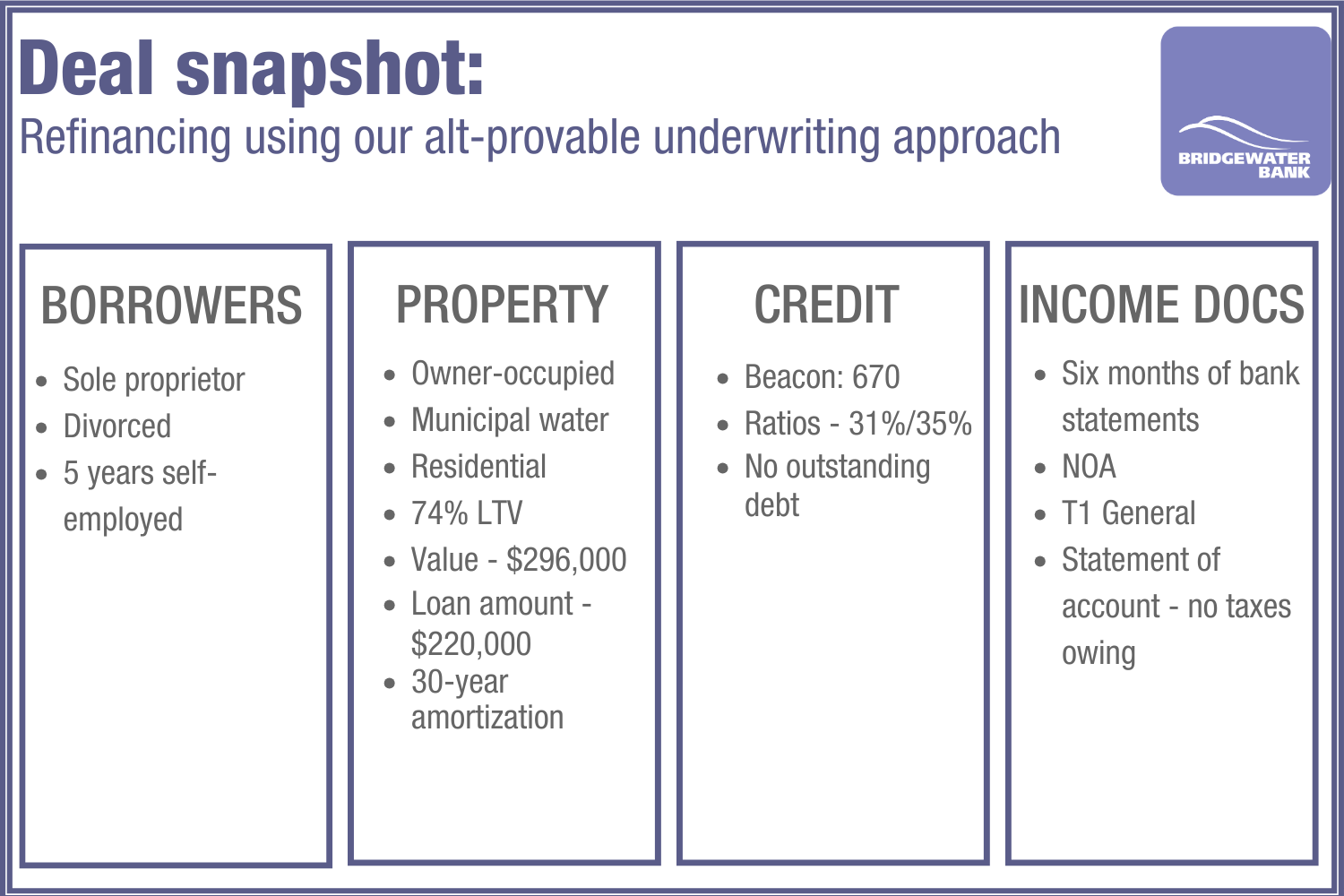

Client background: Our client, a dedicated entrepreneur operating solo, has effectively managed a thriving business for the last five years. Following a divorce and being burdened by a lingering student loan, she resolved to address her outstanding debts, aiming to allocate remaining funds towards bolstering her business.

Objective: The client sought to refinance her home to clear existing debts and infuse capital into her business operations.

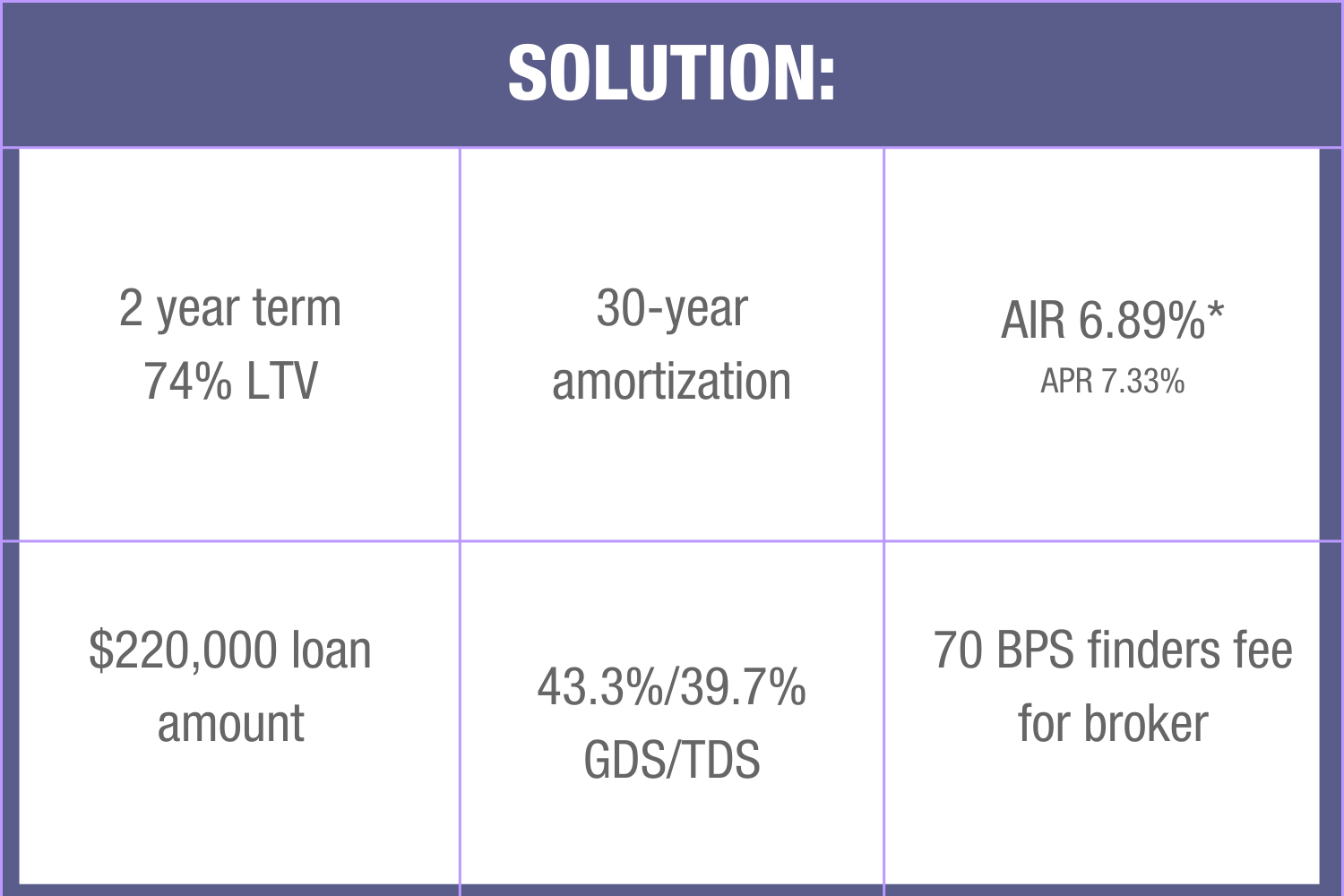

Approach: We can use four income streams from the client’s financials to utilize our innovative, alt-provable underwriting method. Our skilled Underwriter successfully augmented the client’s income using a gross-up strategy. Coupled with a robust business background and good credit history, we recommended a 30-year amortization and a 75% LTV, ensuring a seamless refinance process for the client.

Key steps:

In-depth analysis: The BDM and the broker comprehensively reviewed the client’s financial profile, considering her business longevity and credit situation.

Customized solution: Given the client’s self-employed status and the ability to prove her income with accountant-prepared financials, the expert BDM suggested using our alt-provable underwriting approach and grossing up her income to support a higher income level for the current year.

Documentation requested: We requested a T1 General, 6 months of bank statements and proof of no taxes owing through a statement of account.

Collaborative partnership: Our underwriter collaborated closely with the broker throughout the process, providing guidance and support at every stage to streamline the deal.

Outcome: In a great outcome, the client showcased a robust income stream from her business. Now equipped to inject capital and alleviate debt burdens, she embraces the flexibility and peace of mind offered by the 30-year amortization.

At Bridgewater Bank, we specialize in addressing the distinct requirements of alt-lending clients. Our commitment to empowering brokers ensures that self-employed individuals receive exceptional care and support every step of the way.

*The AIR is compounded semi-annually, not in advance. The APR is based on a $220,000.00 loan on a 2-year term, with a 30-year amortization and loan fee of 1%.