How to Increase Your Clients’ Income Using Add-back and Gross-up Calculation Formulas

Gross-ups and add-backs and adjustable rates… OH MY! There are so many tools available to help get a deal done, that it can be hard to keep track. Don’t fret; let us dig into a few you can use to help your clients see an approval.

Gross-ups and add-backs can both be used to increase certain clients’ income for mortgage qualification purposes. Let’s look at how you can use these on a deal.

Gross-ups: Calculation Formula and Examples

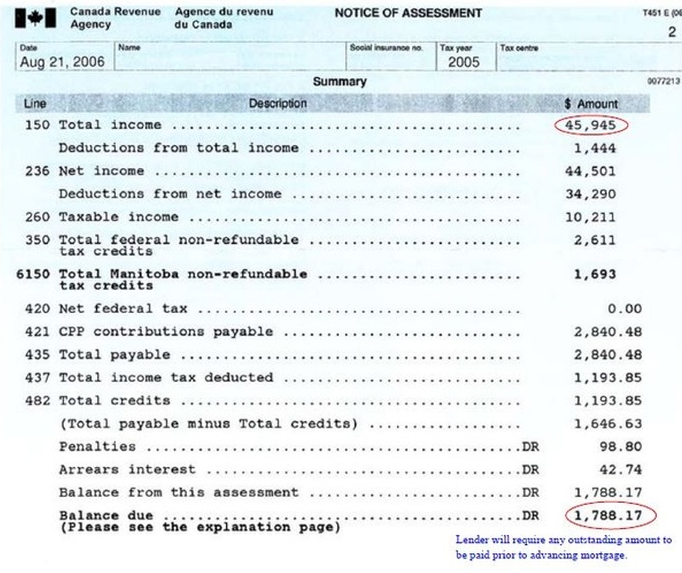

Let’s look at gross-ups first. Non-taxable and non-traditional income can be grossed up to help qualify your client for a mortgage. For your self-employed clients, a standard 15% gross-up can be calculated using their 2-year income average (line 150 from their NOA). Lenders understand a self-employed clients’ income tends to be higher than what is reported on a tax return.

Be sure to disclose if the income average amount includes items other than BFS income – such as interest, RSP income and rental income – as these items cannot be grossed up.

Gross-ups are also commonly used in the case of non-taxable income earners. This includes clients who are:

-

Foster parents

-

Ministry workers

-

Non-taxable pension earners

-

Indian Act Exempt

The standard rule is:

-

Borrowers with non-taxable income less than $30,000 are eligible to have their entire non-taxable income grossed up by 25%.

-

Borrowers with non-taxable income of $30,000 or more are eligible to have their entire non-taxable income grossed up by 35%.

A simple gross-up mortgage example:

Mrs. Jones takes care of two foster children and receives $36,000 a year tax-free.

Borrower(s) non-taxable income X gross-up factor = grossed-up income

$36,000 X 1.35% = $48,600 (total grossed-up income)

For non-taxable income earners, gross-ups are where it’s at. Just be sure that your clients are filing a tax return regardless of whether their earnings are non-taxable.

Add-backs Explained

For other self-employed clients, sometimes add-backs are the better way to go.

Review your client’s tax return along with their NOA to determine what business-related income is. You can extract certain expenses and add them back into line 150 (instead of grossing up). The benefit of add-backs is that in most cases, the resulting income will be higher than a straight 15% gross-up.

Add-backs can be tough to decipher and it’s usually best to leave it to your underwriter to determine what is acceptable. No two businesses are the same, and each company needs to be reviewed individually.

Alternative lenders may consider a higher gross-up percentage than most prime lenders. They can apply specialized add-backs. Bridgewater Bank’s approach takes recent business performance into account, capturing short-term revenue growth and profitability. Consult your BDM or underwriter before submission to discuss.

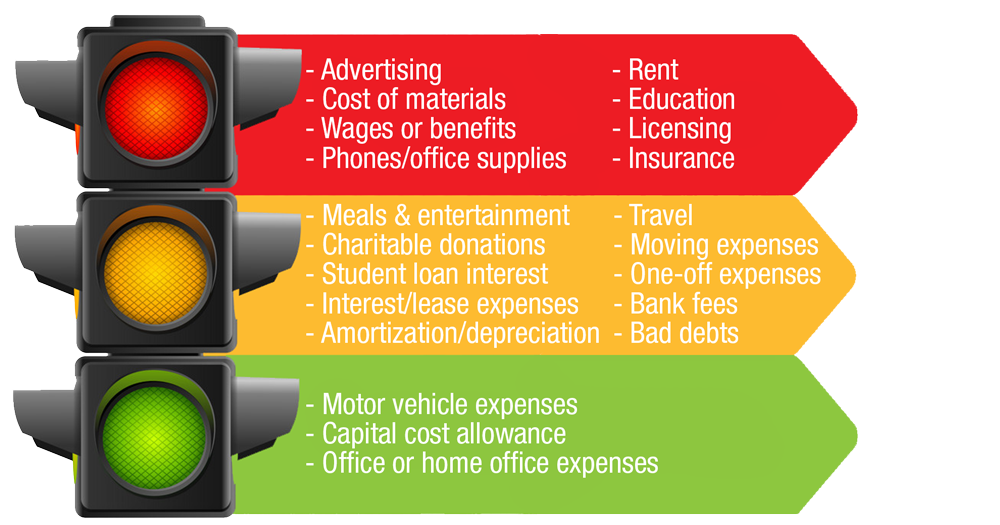

We created a helpful infographic to aid you in understanding how to use add-backs.

-

Red light means stop. These items are generally not acceptable to claim as an add-back.

-

Yellow light means proceed with caution. Your underwriter will consider these items on a case-by-case basis. Consult your underwriter if need be; they’re the experts and happy to help.

-

Green light means go! These items are acceptable and approved by lenders.

When in doubt, let us help you figure it out. Providing your underwriter with the clients’ statement of business activities, T1 summary, and accountant-prepared company financials with your submission will take the guesswork out of what income can be used for qualifying and will also allow for a smooth process and reliable approval.

We hope this information helps clarify these options for your next deal. If there are other mortgage terms you’d like to see explored, please leave us a comment. And make it a tough one; we love a good challenge.