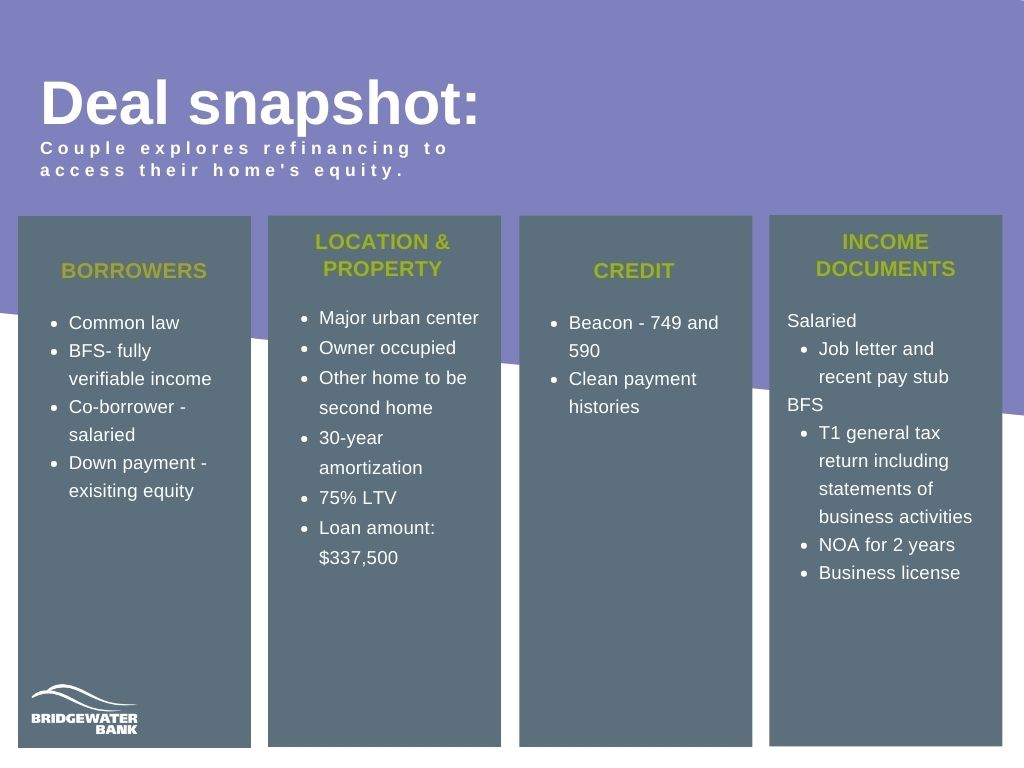

Couple explores refinancing to access their home’s equity

In this case, the clients have been dreaming of building a second home on a plot of land they own together. They have equity in their current home, but they also have some debt they want to pay off. Due to high ratios, primary borrower being self-employed and a low beacon score for the co-borrower, an A lender wasn’t going to approve this deal.

They made the decision to talk to their mortgage broker about how to consolidate their debts and secure a mortgage to build their second home. The expert underwriter could see that they had good payment histories, equity in their existing home and steady income and was able to secure them a great rate at near prime.

Solution:

Their dedicated broker partnered with Bridgewater Bank and refinanced their existing property and used the equity to pay off an unsecured line of credit and they will use the remaining equity to build their second home.

| Term | 1 year |

| Amortization | 30 years |

| Rate | 3.39% |

| Loan amount | $337,500 |

| LTV | 75% |

| GDS/TDS | 27.71%/45.77% |

| Down payment | Existing equity |

| Fee | 1% ($3,375) |

| Finders fees paid to broker | 60 bps |

| Turnaround time | Funding: 20 days |