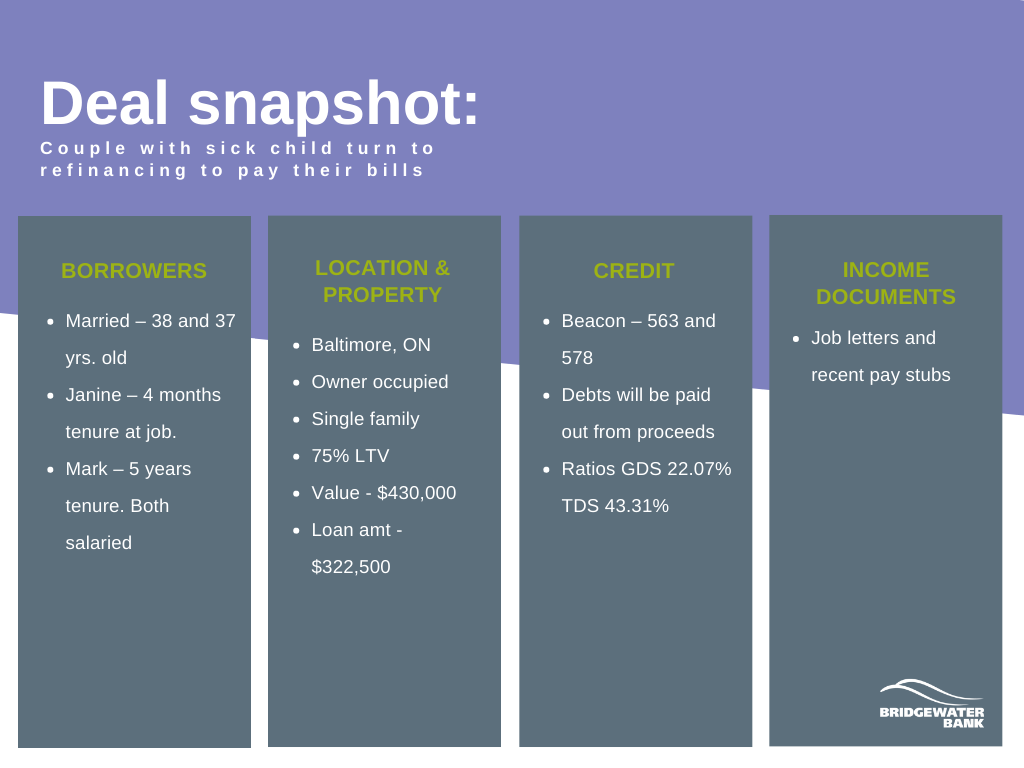

Couple with sick child turn to refinancing to pay their bills

Janine and Mark were both working full time and paying their bills when their child suddenly fell ill. As any mother would do, Janine took on the obligation of caring for her child’s needs, which meant taking an indefinite amount of time off from work.

This also meant putting important bills to the side until there was money to pay them. Janine’s husband continued to work over the course of their child’s illness, but the bills continued to accumulate. Thank goodness their child is better now, and Janine has gone back at work.

Janine and Mark decided to refinance their owner-occupied home to pay off the mounting debt as advised by their mortgage broker.

Solution:

Janine and Mark’s mortgage broker sent their file to Bridgewater Bank. The Gateway Simple Mortgage was the product that fit with their circumstances as they are both salaried employees with confirmed income. This 1-year term will allow Janine and Mark to pay off their debts and start rehabilitating their credit, eventually moving into a lower rate mortgage.

| Term | 1 year |

| Amortization | 30 years |

| Rate | 4.99% |

| Loan amount | $322,500 |

| LTV | 75% |

| GDS/TDS | 22.07%/43.31% |

| Down payment | equity |

| Fee | 1% ($3,225) |

| Finders fees paid to broker | 60 bps |

| Turnaround time | Commitment: 1 day; Funding: 23 days |