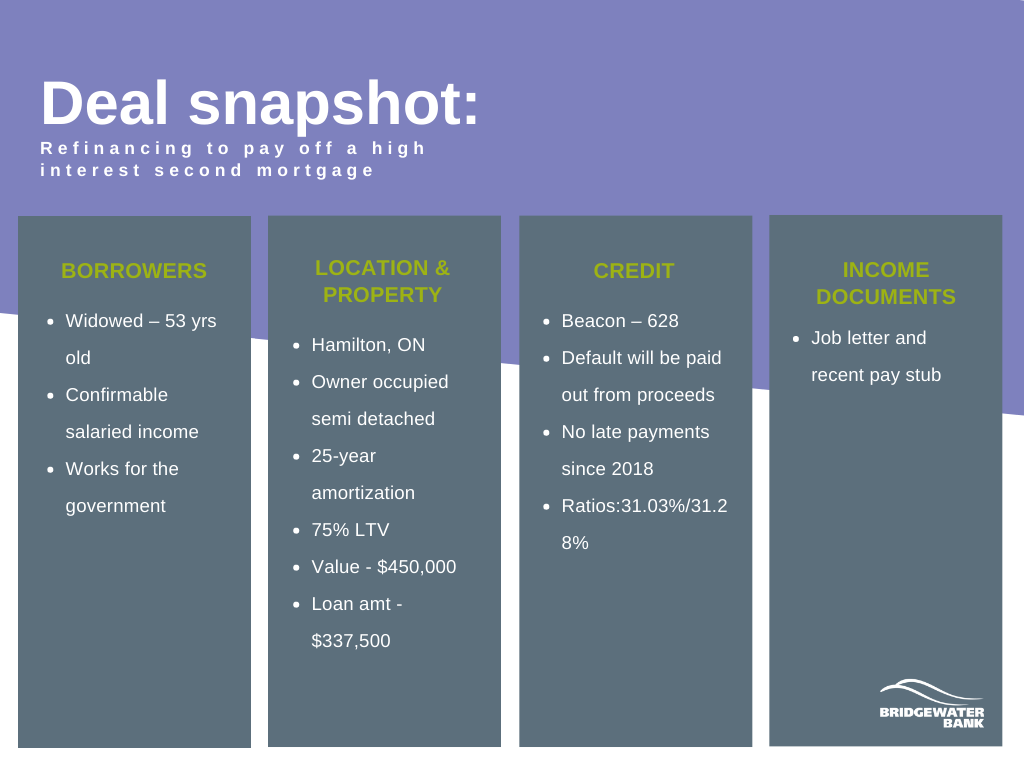

Refinancing to pay off a high interest second mortgage

Jason is a salaried government worker who’s been in the same job for many years. When Jason’s wife suddenly fell ill, he took on a lot of costs caring for her. These bills went into default and then sadly, Jason’s wife passed away. Her funeral expenses were too high to pay out of pocket after all the medical bills he had been paying.

Jason took out a second mortgage on the house to pay for the funeral and now he is ready to refinance his home in order to pay off that second mortgage as the interest rate is very high.

Solution:

Jason spoke to his mortgage broker who sent the deal to Bridgewater Bank, knowing Bridgewater’s Gateway suite of products would offer a solution. With a 2-year term, Jason will be able to pay off his second mortgage and defaulted debt and then move into a lower rate mortgage in the future.

| Term | 2 year |

| Amortization | 25 years |

| Rate | 4.69% |

| Loan amount | $337,500 |

| LTV | 75% |

| GDS/TDS | 31.03%/31.28% |

| Fee | 1% ($3,375) |

| Finders fees paid to broker | 70 bps |

| Turnaround time | Commitment: 1 day; Funding: 23 days |