Purchasing a home after a consumer proposal

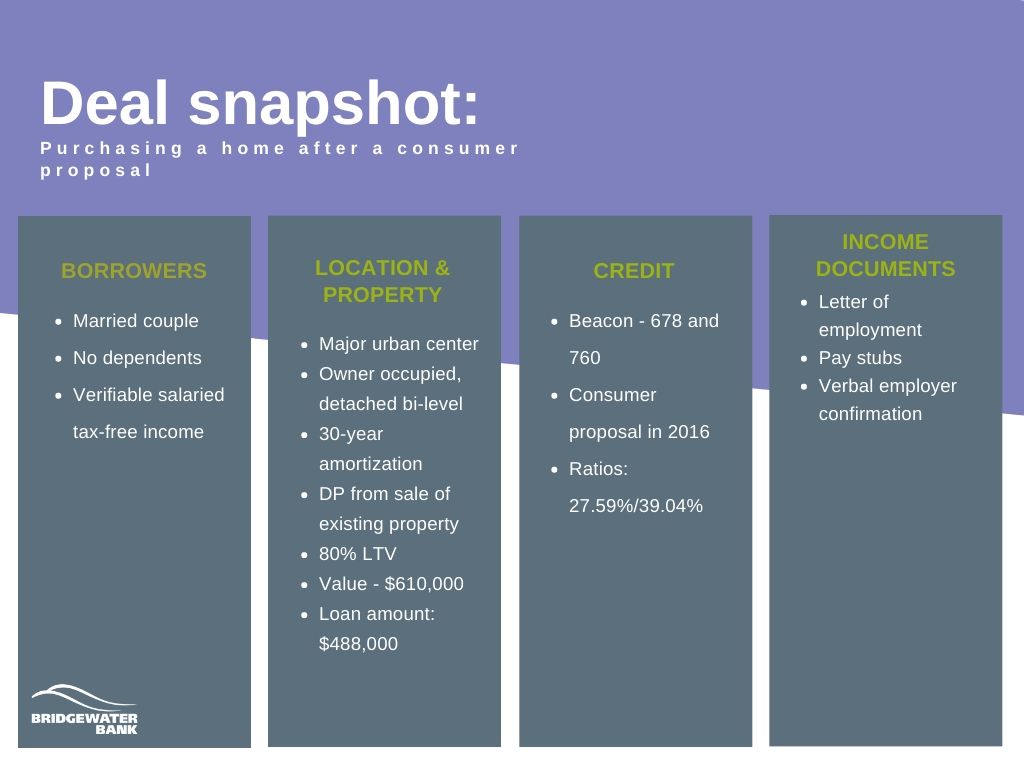

Tyler and Raya are a happily married couple looking to purchase an owner-occupied property in a major urban center. They will be selling their current property in order to purchase a new one.

They have good credit, but Tyler filed a consumer proposal in 2016 which is making their mortgage acceptance difficult. The consumer proposal was paid shortly after filing and trades have all been paid as agreed. Their down payment will come from the sale of their existing property.

Raya called her mortgage broker as the consumer proposal made it difficult to gain an approval from their A lender.

Solution

It can be difficult to gain a mortgage approval after a consumer proposal which is why Tyler and Raya’s broker sent their deal to Bridgewater Bank. Bridgewater Bank underwriters work to understand the story behind client financial setbacks in order to get them the mortgage they need.

Tyler and Raya took on a 2-year term, giving them the time needed to work out their finances and move to a lower mortgage rate at renewal.

| Term | 2-year |

| Amortization | 30 years |

| Rate | 5.09% |

| Loan amount | $488,000 |

| LTV | 80% |

| GDS/TDS | 27.59%/39.04% |

| Fee | 1% ($4,880) |

| Finders fee paid to broker | 70 bps |

| Turnaround time | Commitment: 1 day Funding: 23 days |