Refinance to consolidate debt and increase monthly savings

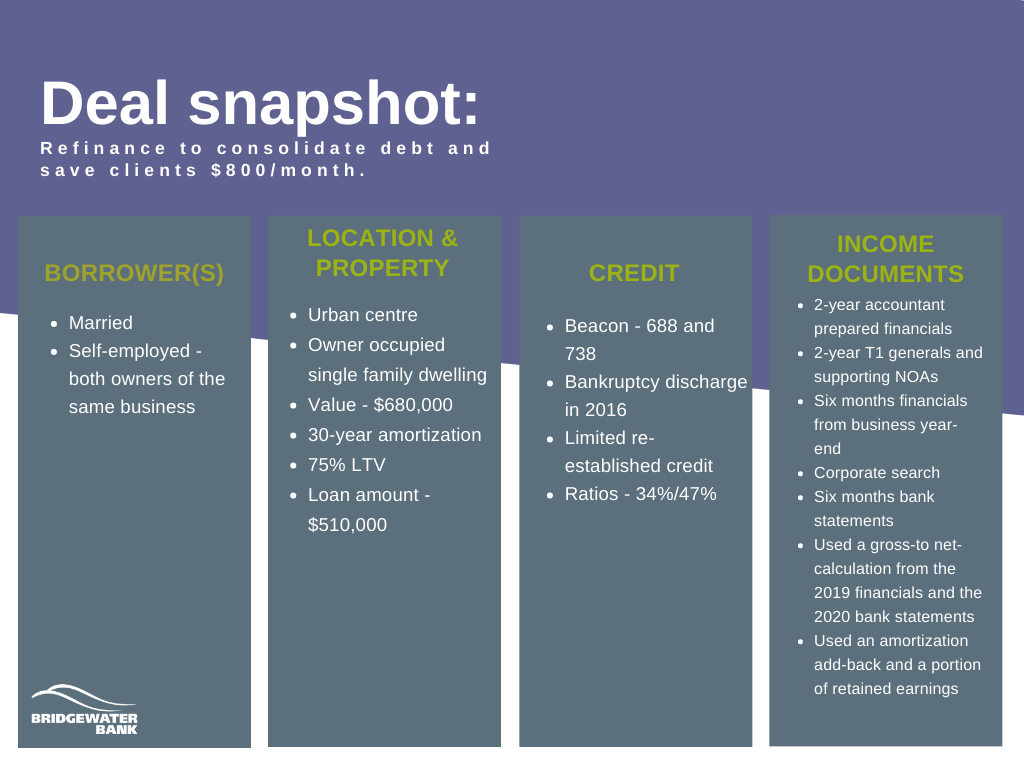

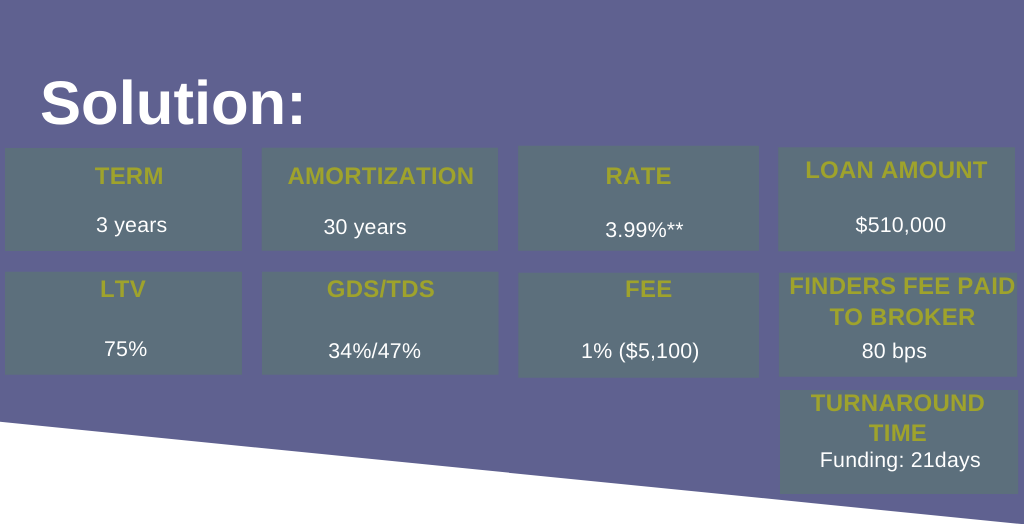

In this scenario, we show how one broker worked with our expert underwriter to refinance his clients’ home to consolidate debt. This freed up nearly $800 per month for the clients, which will allow them to pay off their debts during the three-year term.

Due to high ratios, this deal wouldn’t have been considered by an A lender – the clients were both self-employed, and there was a bankruptcy on file. The broker presented the deal to Bridgewater Bank because they knew that, being an alternative lender, we’d be willing to look deeper into the clients’ backgrounds and offer a solution at a good rate.

**The AIR is compounded semi-annually, not in advance. The APR based on a $510,000 loan with a 30-year amortization and loan fee of 1% is 4.33%.

All terms and conditions subject to change without notice; see BwBbrokerinfo.ca for details. For internal use only (brokers, agents and affiliates). Not intended for external consumer use.