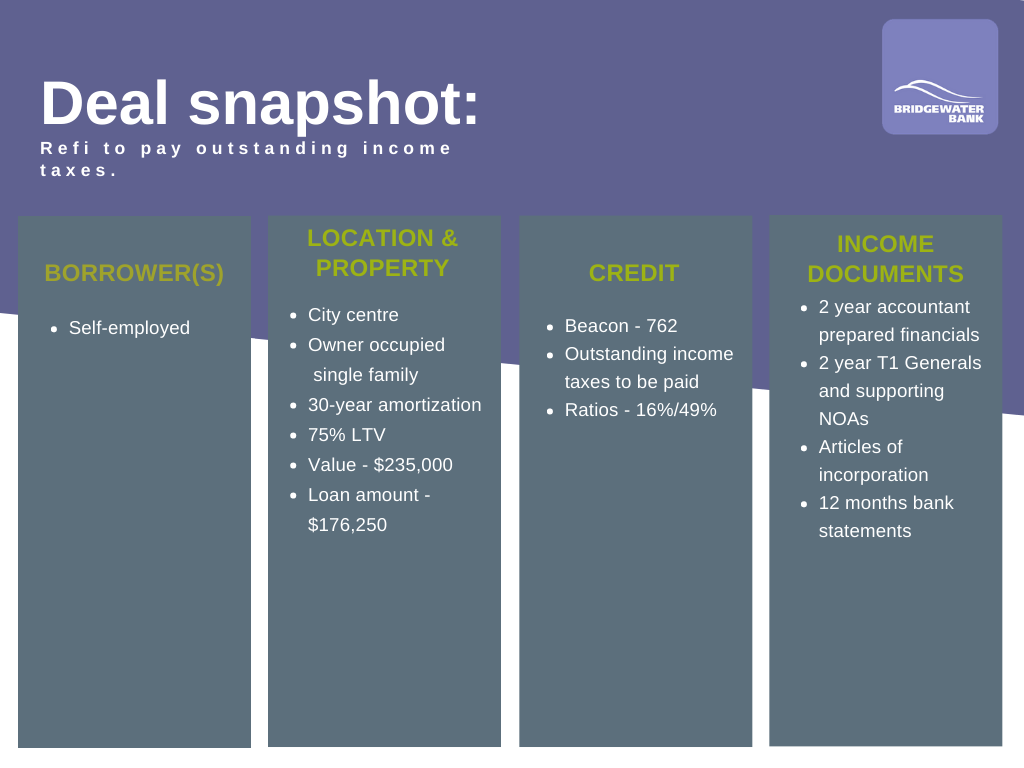

Refinance to pay off outstanding income taxes

In this scenario, the client refinanced his owner-occupied property to consolidate debt and pay an outstanding income tax bill.

The file had high ratios and substantial income taxes owing. Our expert BDM worked with the broker to understand the story behind the unpaid taxes, rather than turning it down sight unseen.

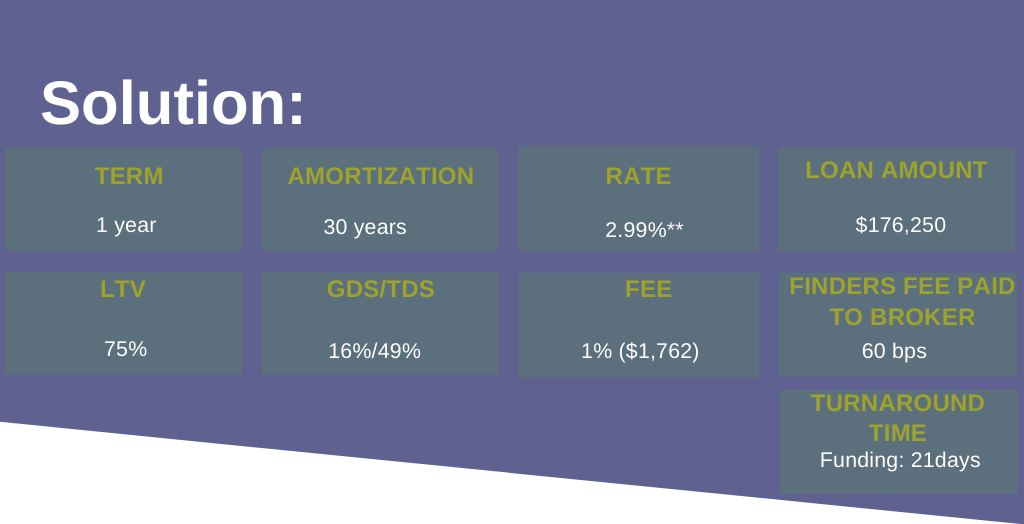

Our expert underwriter could see that the client had a strong income and the property was in a city center. This allowed us to price it aggressively with a 2.99% rate on a one-year term. Moreover, with access to this equity, this client was able to pay off his taxes, which in turn could qualify him for an even lower rate when it’s time to renew.

**The AIR is compounded semi-annually, not in advance. The APR based on a $176,250 loan with a 30-year amortization and loan fee of 1% is 4.00%.

All terms and conditions subject to change without notice; see BwBbrokerinfo.ca for details. For internal use only (brokers, agents and affiliates). Not intended for external consumer use.