Refinance to pay out debt and remove ex-spouse from title

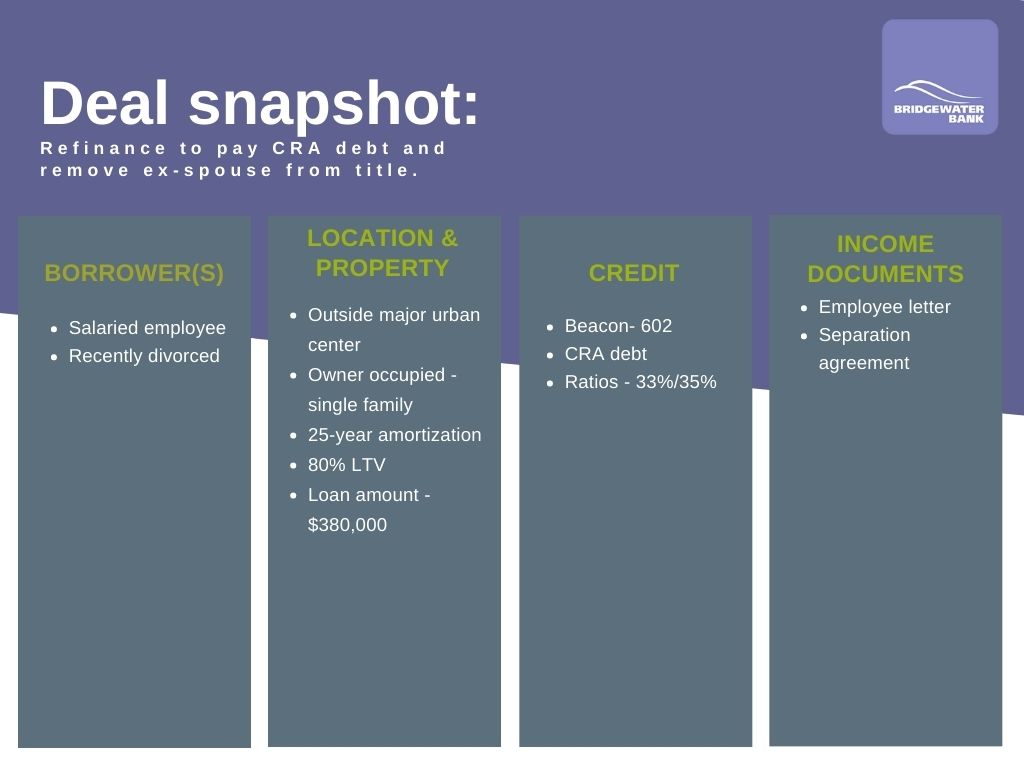

In this deal scenario, the client refinanced his owner-occupied home to take his ex-spouse off title and settle CRA debt.

This deal was not your average deal. Thankfully, our underwriter is not your average underwriter. Our client was in a tight spot as he navigated this tumultuous life event, and our underwriter managed to bring his debts in line and reach the 80% LTV goal.

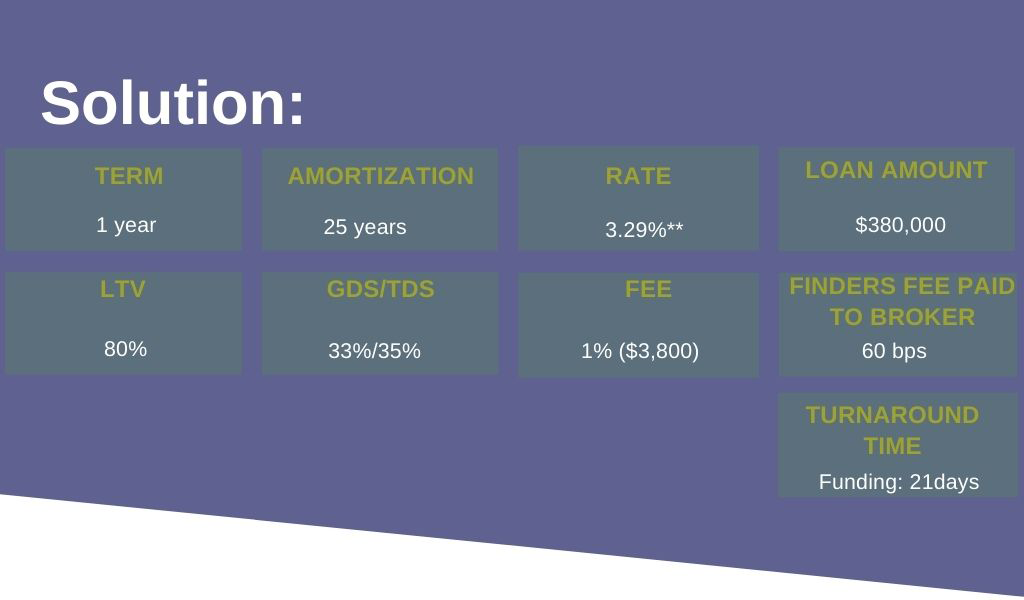

As obstacles beyond the client’s control continuously came up, our underwriter and BDM accommodated the timeline and on-hand documentation. We’ve always been proud of our old-school human touch, and there was a person on the other end of this deal who needed extra time and patience. So that’s what we did.

The result was a great rate of 3.29% on a one-year term. This allowed the client room to pay out debts and get his credit in order to renew at a lower rate in the future, perhaps with an A lender. And his broker now has the opportunity to help this client with his exit strategy and work with him again at renewal.