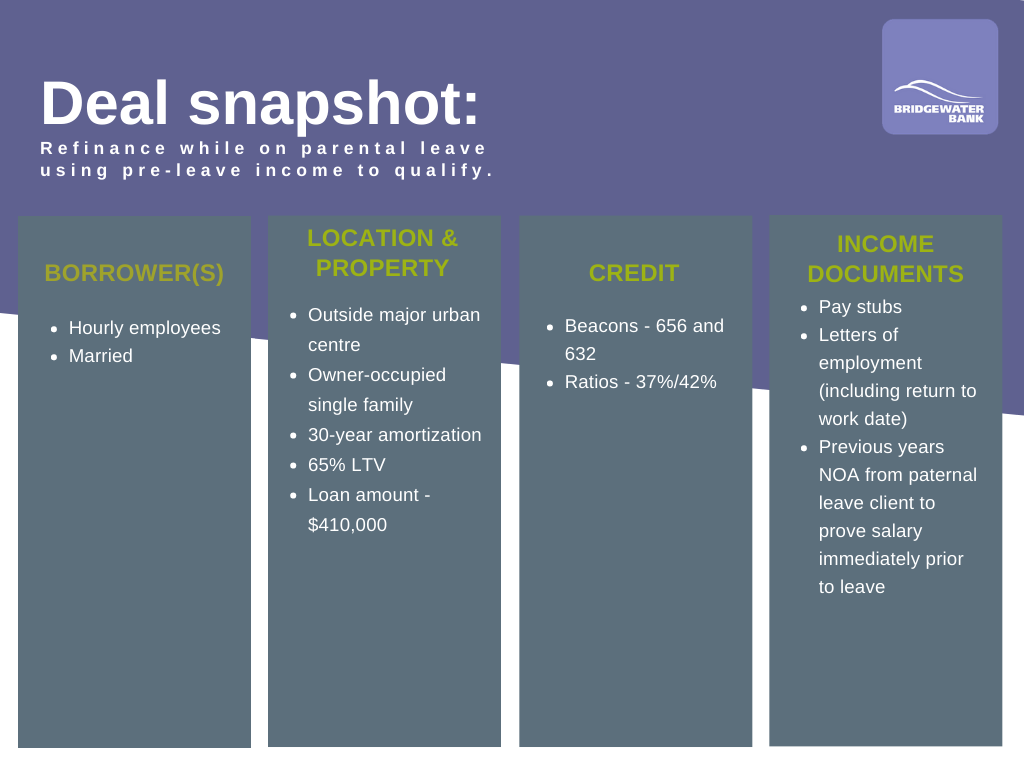

Refinance while on parental leave using pre-leave income to qualify

In this deal scenario, our experts helped new parents refinance their property using 100% of their pre-leave income to qualify. This is because they were due to return to work within 60 days of application (clients on leave can normally use up to 60% of their pre-parental leave income if their return-to-work date is over 60 days).

The property was outside of a major urban centre, and the clients had a few credit mishaps in the past. But based on the merits of the deal, our underwriter was able to approve on a 2-year term and at a rate much lower than their current one.

They now have the extra money they need to renovate their home and accommodate their growing family.

**The AIR is compounded semi-annually, not in advance. The APR based on a $410,000 loan on a two-year term, with a 30-year amortization and loan fee of 1% is 5.30%.

All rates are subject to full underwriting policy and may change without notice.

Should you have questions, please contact your BDM.For internal broker use only. Not intended for external consumer use.