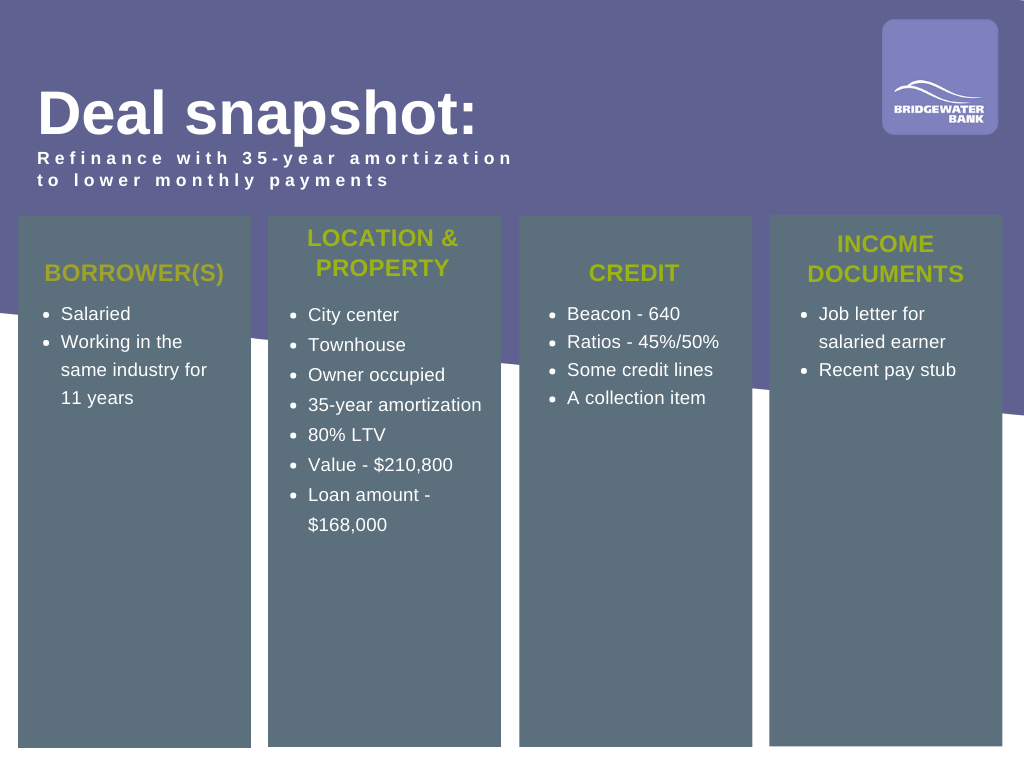

Refinance with 35-year amortization

In this scenario, the client refinanced their owner-occupied property with a 35-year amortization to reduce monthly payments.

Parminder is a sole borrower working full-time within the same industry for the last 11 years. Parminder is trying to lower their monthly payments to help pay off debt. Their mortgage broker knew Bridgewater Bank would be the right fit.

Our expert BDM worked with the broker to understand the story behind the debt. Parminder recently went through a tough separation and was only a few months into a new job. With interest rates on the rise, affordability weighed heavy on Parminder’s mind.

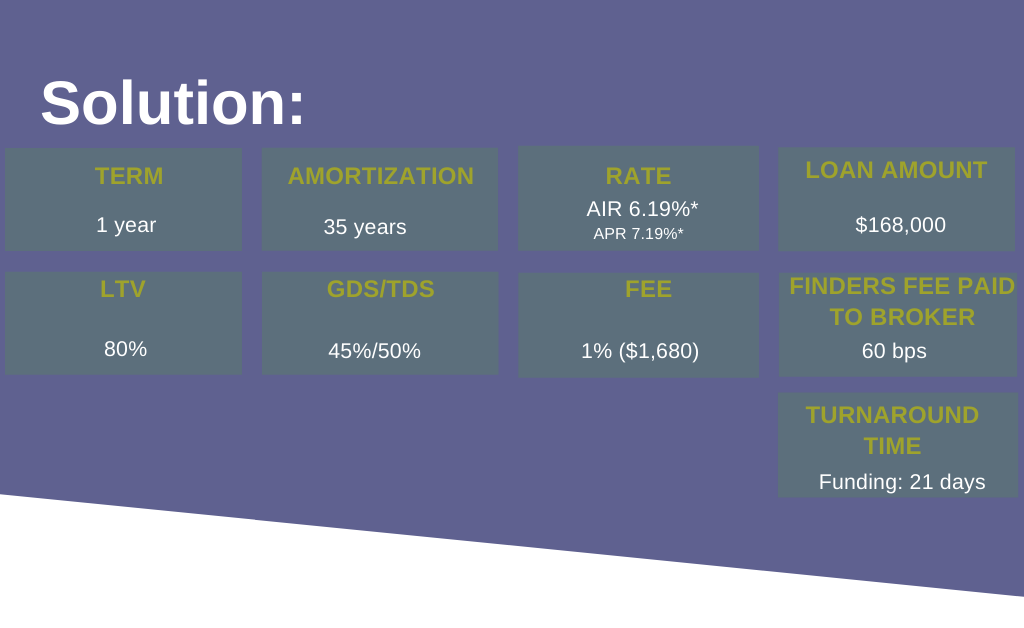

We could see that the borrower had a strong income, and the property was in a city center. Based on the merits of the deal, we were able to approve a 1-year term at 6.19%* with a 35-year amortization. This ultimately lowered Parminder’s mortgage payments by over $800 a month.

The borrower now has extra money to go towards paying off their debt, which will lower their ratios for when it’s time to renew. Deal done.

*Mortgage rates are compounded semi-annually, not in advance. The information on this page is for internal broker use only. Not intended for external consumer use. All rates are subject to full underwriting policy and may change without notice. Should you have questions, please contact your BDM.