Refinancing two properties to lower monthly payments

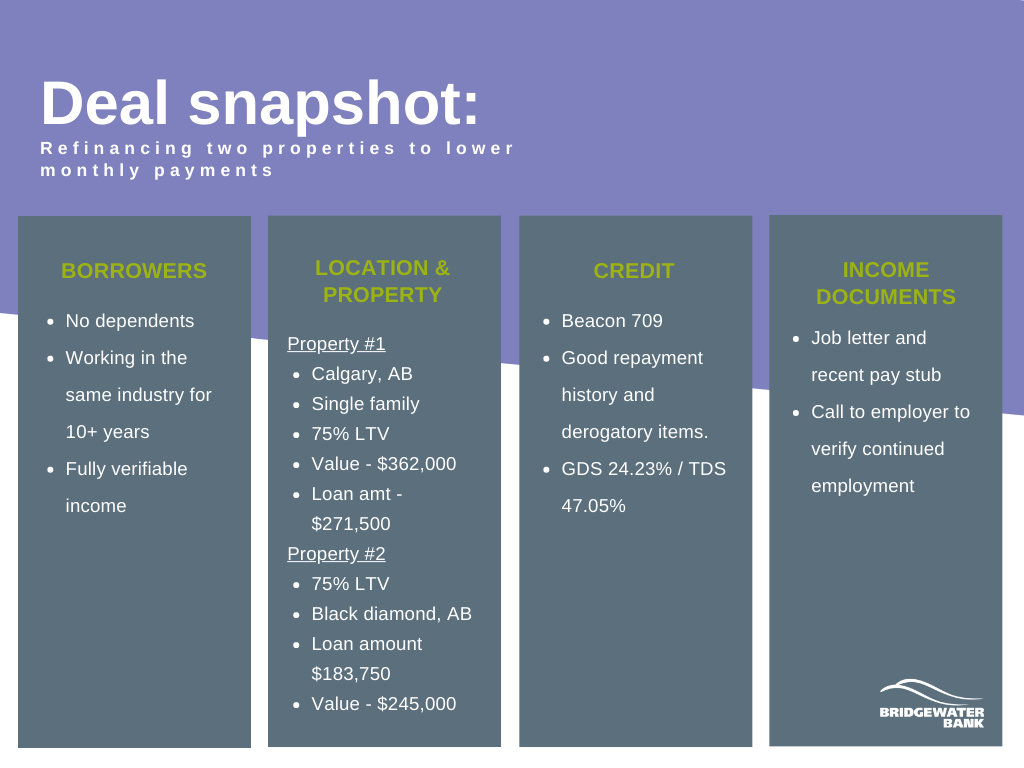

Danny is a sole borrower working full time. He has had the same job for more than ten years. Danny has two mortgages, one on his owner-occupied home, the other on his disabled parent’s home.

Danny is trying to lower his monthly payments to increase his savings.

He called his mortgage broker to help him assess his options. His broker knew that if he refinanced both properties, he could get a great rate on his owner-occupied home since it is in a desirable location and in good condition. Danny has a story to tell; he is taking care of his disabled, aging parents, paying his bills on time and has steady income – all of which look positive to a lender underwriter.

Danny’s ratios are a bit high for an A lender and his parents live in a secondary market location (outside a major urban center) leading Danny to refinance with an alternative lender.

Solution(s):

Danny’s broker thought of Bridgewater Bank for this deal. Their expert underwriters and sales team are always available to discuss a deal and find a solution.

The Gateway suite of products was designed with clients like Danny in mind. Both refinances were done, and Danny’s monthly payments were reduced thanks to the great rate he received on his owner-occupied property. To top it off, his broker collected two finder’s fees – a win/win situation!

| Term | 2 year |

| Amortization | 30 years |

| Rate | 3.99% |

| Loan amount | $271,500 |

| LTV | 75% |

| GDS/TDS | 24.23%/47.05% |

| Fee | 1% ($2,715) |

| Finders fees paid to broker | 70 bps |

| Turnaround time | Commitment: 1 day; Funding: 23 days |