5 Things Mortgage Brokers Should Do To Be Successful

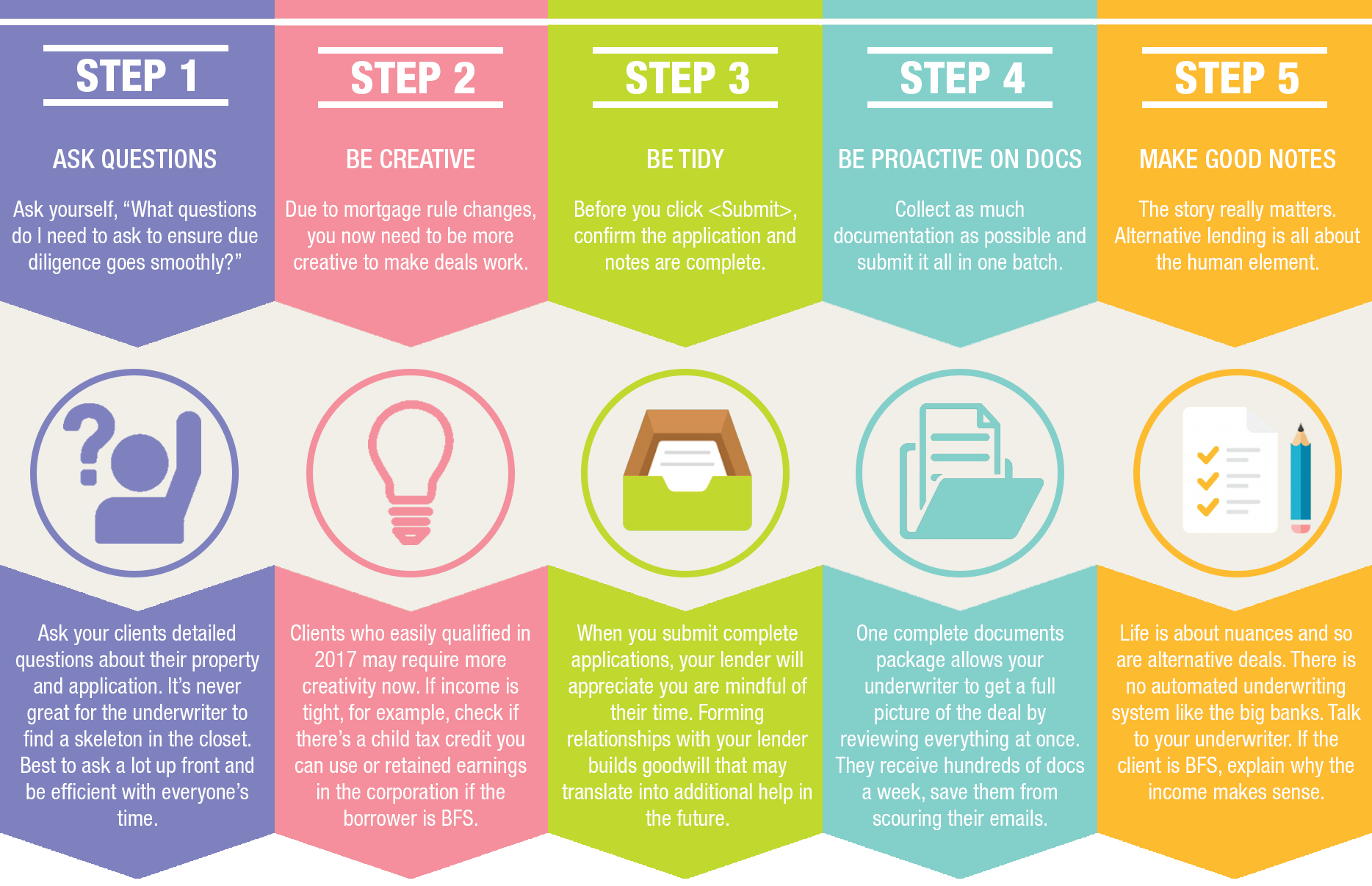

As mortgage rules continue to change with more obstacles to make deals work, brokers can use all the extra help they can get. From asking questions and being creative to simply making good notes, we want to help you succeed in alternative lending, so we’ve put together five important steps in a handy-dandy infographic called ‘improving your odds of success’.

Download the infographic below here.

Step 1: Ask Questions

Some examples of questions to ask your clients: Does the current pay stub support the level of overtime? If the property is rural, are there any outbuildings? If so, make sure the client doesn’t needlessly pay for an appraisal if the outbuildings can’t be used in the valuation. If the borrower’s company is a numbered company, what is the type of work and that company’s actual purpose?

Step 2: Be Creative

The new mortgage rules have made the entire lending space more challenging. One way to overcome any obstacles is to be more creative, particularly, in the way deals are put together. For example, if income is tight check if there’s a child tax credit or if self-employed can use retained earnings to make a deal work.

Reach out to your BDM and the two of you can figure out ways to get creative on your file and help your client.

Step 3: Be Tidy

Mortgage brokers know the value of complete applications and the importance of saving your underwriter inquiry and approval time. One area that some brokers forget to complete is the assets section. Too many brokers leave off assets such as vehicles or RRSPs. Note: Steady RRSP savings, even if small, can show discipline. That raises the odds the client will pay if times get tough.

Also Read: 5 LinkedIn Profile Tips to Help Brokers Get More Leads

Step 4: Be Proactive on Documents

Complete document packages are efficient for both you and your underwriter. Instead of sending five documents in five separate emails, gather everything together and send it in one email to your underwriter.

Step 5: Make Good Notes

As you’re now excruciatingly aware, the story matters! If Joe is divorcing, downsizing his home, and had some late payments while making this transition and paying lawyer fees, you need to paint that picture with vivid ink. If the client is BFS, explain why the income makes sense for their business. If the borrower had a negative credit event (e.g., bankruptcy), explain why it happened and why it will never happen again.