From payments to possibilities

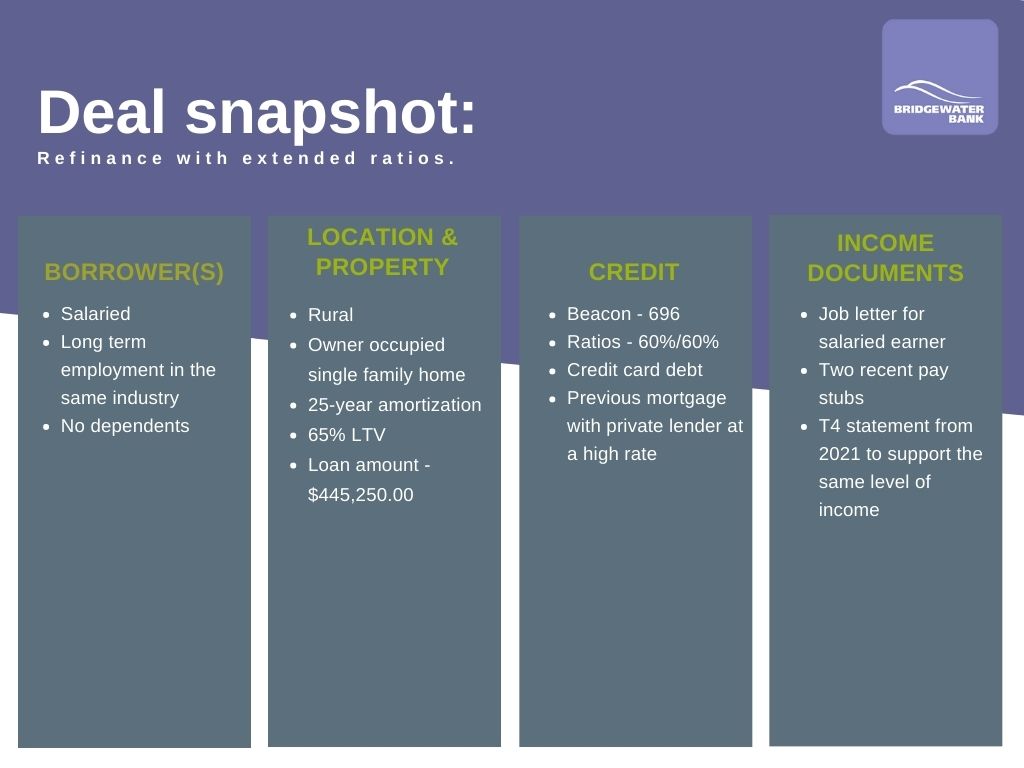

In this scenario, the client was able to refinance their owner-occupied property and come out ahead due to our extended ratios.

Alex held a mortgage with a private lender and wanted to lower their monthly payment and complete some much-needed renovations. In their current arrangement, the mortgage payment only covered interest and only paid down the minimum required for credit cards. The broker recognized that there were much better financial options out there for Alex and brought the deal to Bridgewater Bank.

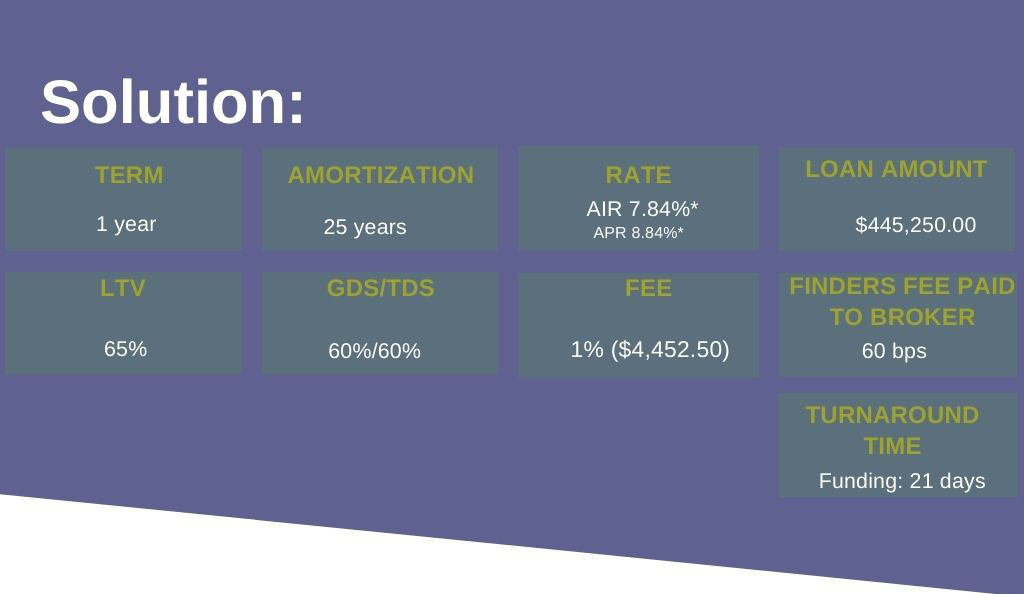

Our exceptional BDM and underwriter worked with the broker to understand Alex’s story. It became apparent that there were simple possibilities for them to make gains, including paying down their principal. With our new extended ratios, the refinance would pay off the credit card debt, and additional funds would be available for home improvements. Their payments were also reduced by over $300/month!

Fresh start, fresh paint, and an improved credit rating. Alex’s broker gave them the foundation to move forward financially and be positioned for a better rate when they renew next.

**The AIR is compounded semi-annually, not in advance. The APR is based on a $445,250.00 loan on a 1-year term, with a 25-year amortization and loan fee of 1% is 8.84%.

All rates are subject to full underwriting policy and may change without notice. Amounts over the above-stated limits may be available on a case-by-case basis. Geographic, property, and credit restrictions apply.

Should you have questions, please contact your BDM.

For internal broker use only. Not intended for external consumer use.