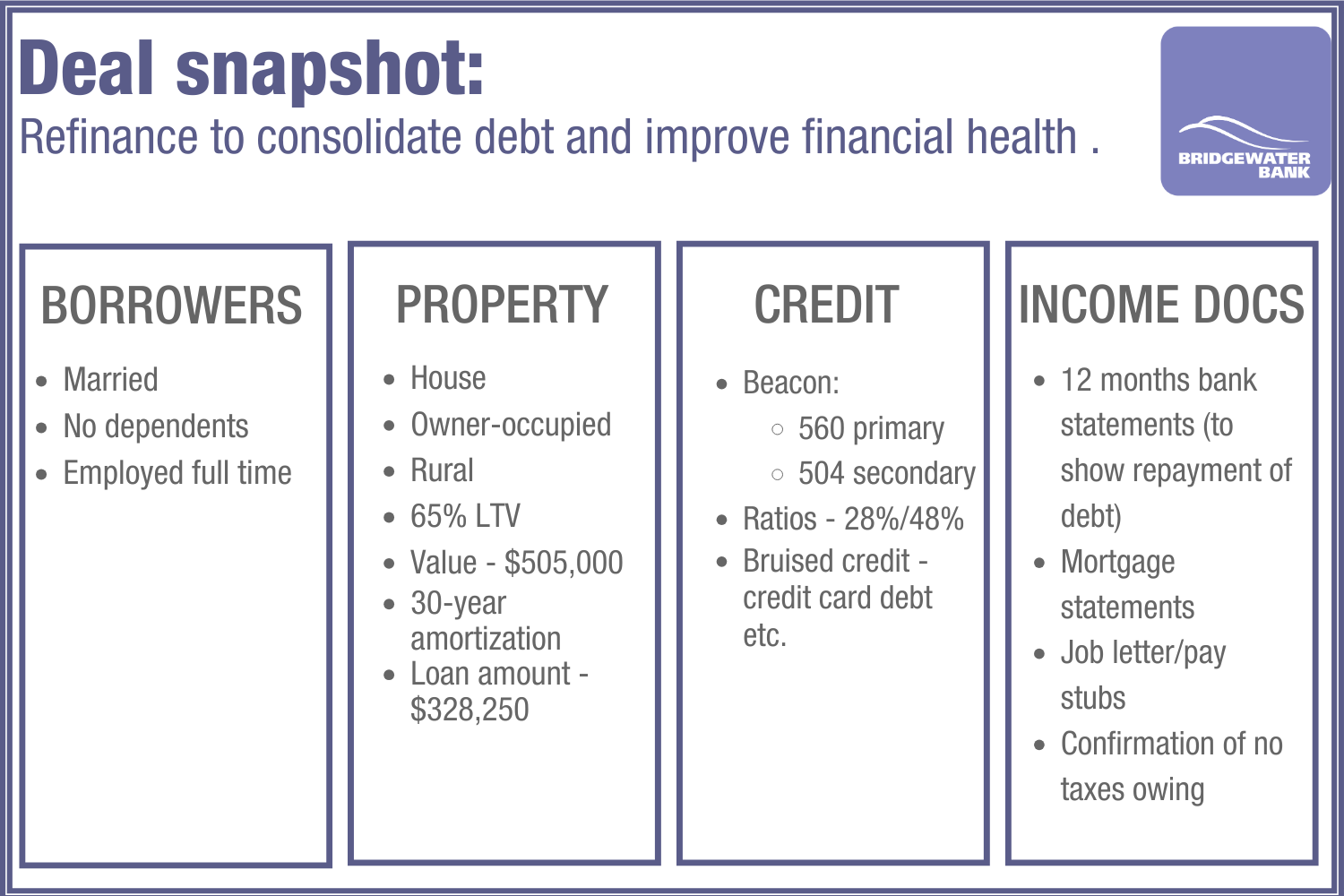

Helping clients refinance to consolidate debt and improve their financial health.

Client background: These clients were facing financial challenges and needed help getting back on track.

Objective: The clients wanted to rebuild their credit by refinancing their home to pay off debt.

Approach: Our expert underwriter looked at the full picture to approve this deal. One client had a low credit score, so alternative credit proof was requested to assess their debt repayment habits. Both clients had stable employment and demonstrated pride of ownership in their home of five years, as shown through the appraisal. The underwriter saw that paying off their debts with the refinancing proceeds would put them in a much better credit position.

Key steps:

In-depth analysis:

-

- The underwriter carefully reviewed the clients’ financial profiles and credit situation.

- The underwriter also reviewed the reasons behind the high debt levels and determined that the debt usage was reasonable and aligned with the applicants current life stage.

Customized solution:

-

-

- We requested alternative credit verification to better understand their efforts to repay debts.

- The underwriter reviewed the explanation for the debts and confirmed that the refinance goal was focused on consolidating and reducing credit exposure for a stronger financial future.

- Combined with their steady employment and an appraisal showcasing the pride they take in their home, the deal was approved.

-

Documentation requested:

-

-

-

- Job letter

- Paystubs

- 12 months bank statements (to show regular repayment of debt and demonstrate credit worthiness)

- Proof of no taxes owing

- Mortgage statements as the mortgage didn’t show up on the credit check to confirm outstanding balance for payout list as well as clean repayment

-

-

Collaborative partnership:

-

- Our underwriter worked closely with the broker, providing guidance and support throughout the process to ensure a smooth experience.

Outcome:

The clients successfully refinanced, cleared their debts, and are now on track to rebuild their credit. At renewal, they’ll qualify for a mortgage with a lower rate, significantly improving their financial outlook.

At Bridgewater Bank, we specialize in helping clients with unique circumstances. Together with brokers, we ensure that clients with bruised credit get the care and solutions they need to succeed.