Recovery after a life event

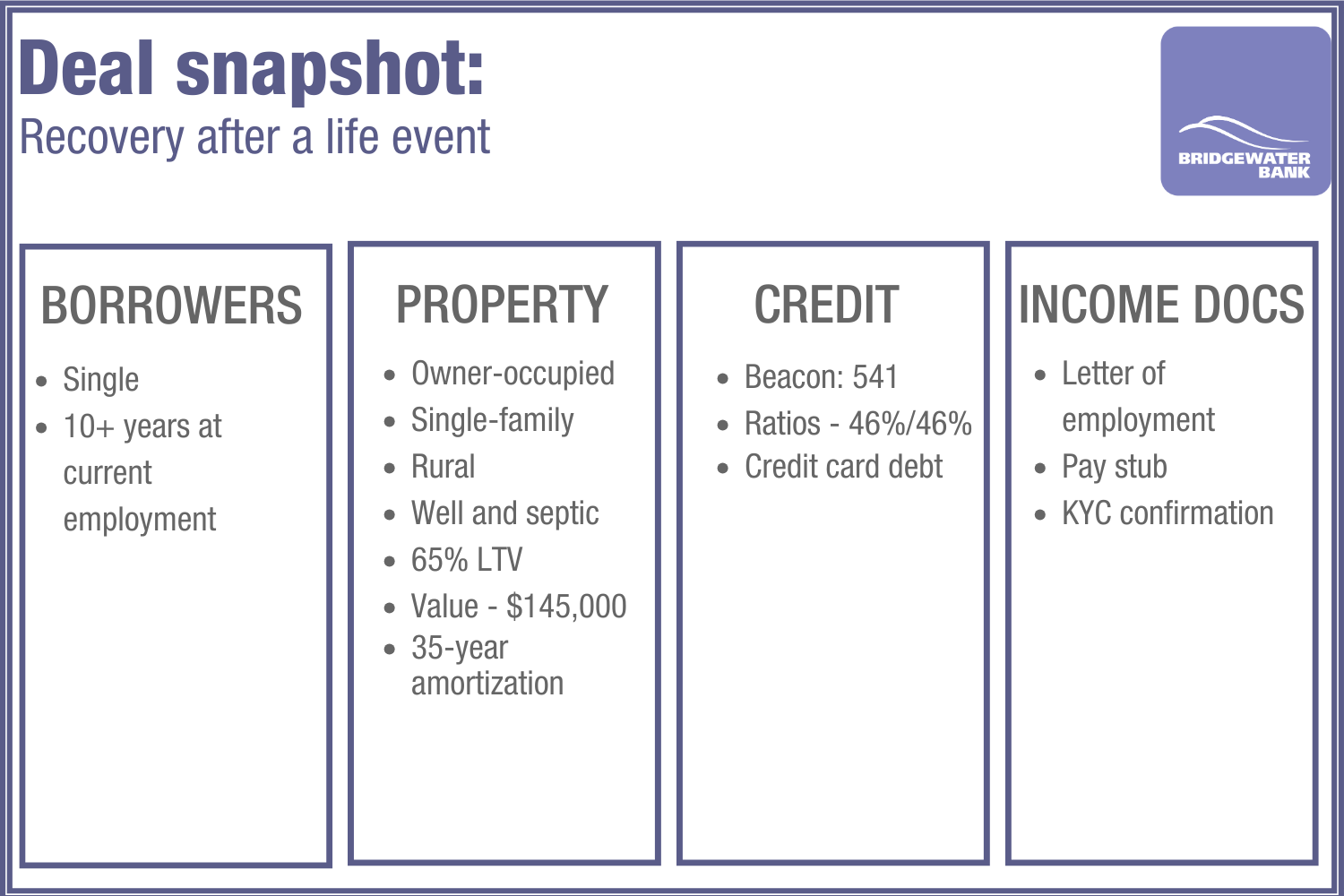

This deal scenario is based in a rural community. The client needed financial assistance while recovering from medical treatment. With their variable-rate mortgage payments increasing, they sought a more stable solution through refinancing. The mortgage broker worked with our expert BDM and underwriter to map out the best options.

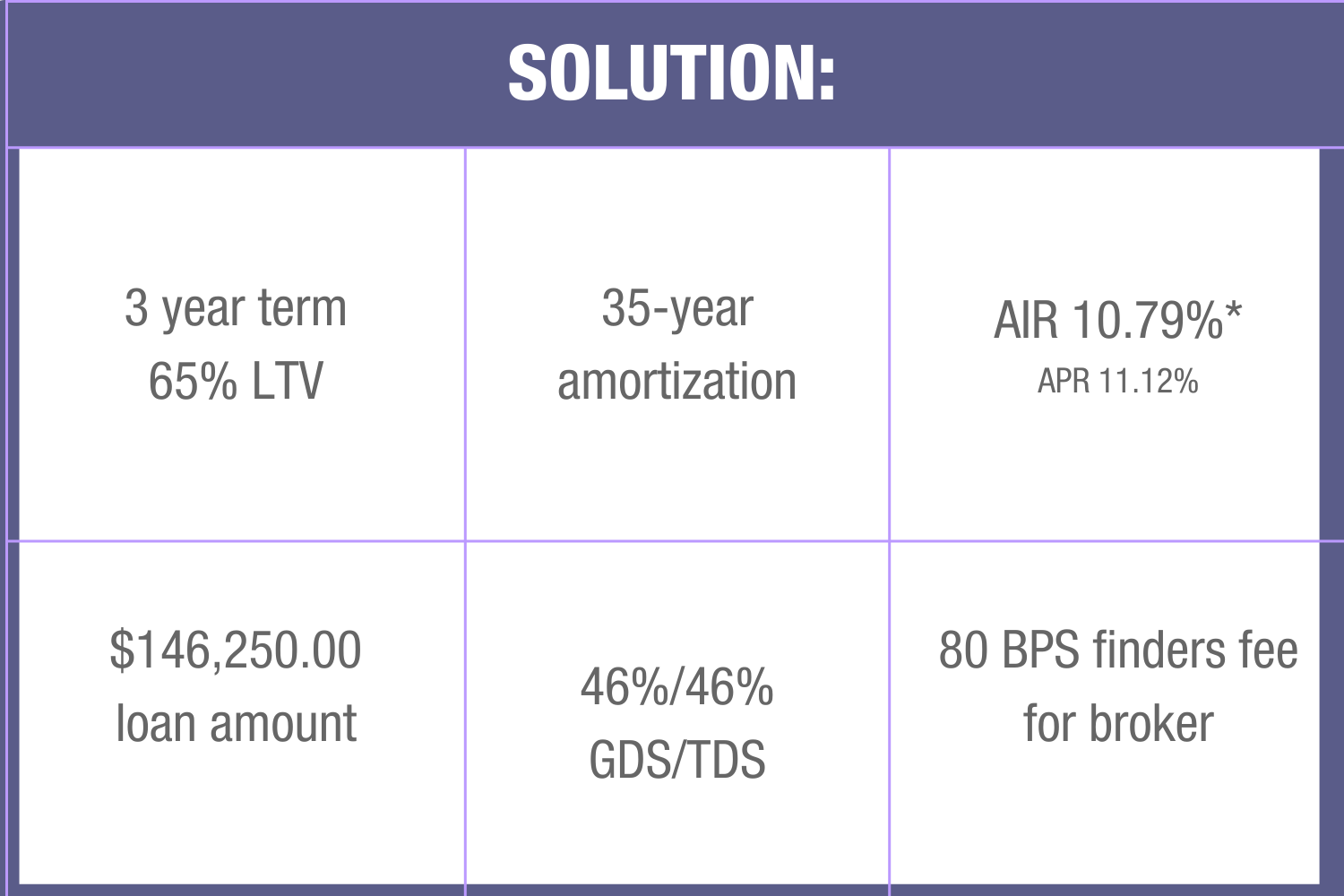

By moving to a 35-year amortization with a 3-year term, the client was able to improve their beacon score (below 550) by paying off all debt. With an LTV of 65% and ratios of 46.31/46.34, solid home equity, and stable employment, we were able to see the value in supporting this deal. Ultimately, this refinance reduced their monthly payments and paid off debt, giving them the reprieve they needed.

*The AIR is compounded semi-annually, not in advance. The APR is based on a $146,250.00 loan on a 3-year term, with a 35-year amortization and loan fee of 1% is 11.12%.

All rates are subject to full underwriting policy and may change without notice. Amounts over the above-stated limits may be available on a case-by-case basis. Geographic, property, and credit restrictions apply.

Should you have questions, please get in touch with your BDM.

For internal broker use only. Not intended for external consumer use