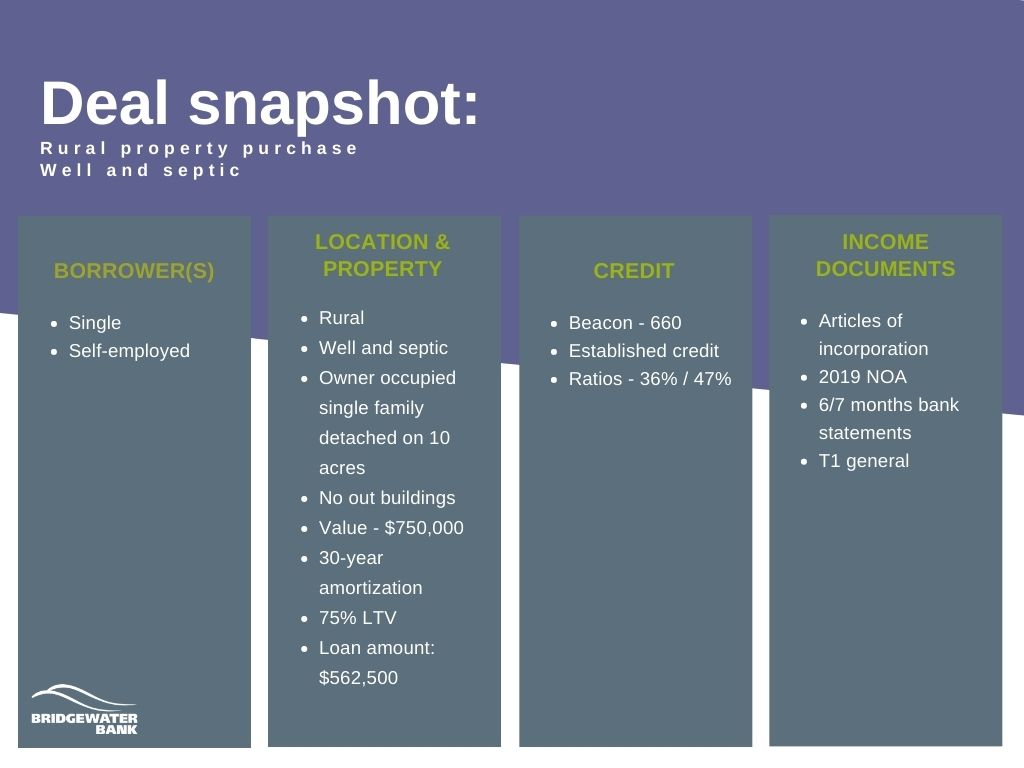

Rural property purchase – well and septic

In this case, a self-employed client was able to purchase his dream home on a 10-acre, well and septic rural property.

This client’s ratios were higher than what an A lender would approve. Proving income required an expert underwriter to build a financial picture. With all of these details in mind, the broker knew the deal would be a great fit for an alternative lender.

Bridgewater Bank lends in a variety of areas, most are beyond that of A lenders. We also understand and value self-employed clients, a growing market with a ton of potential.

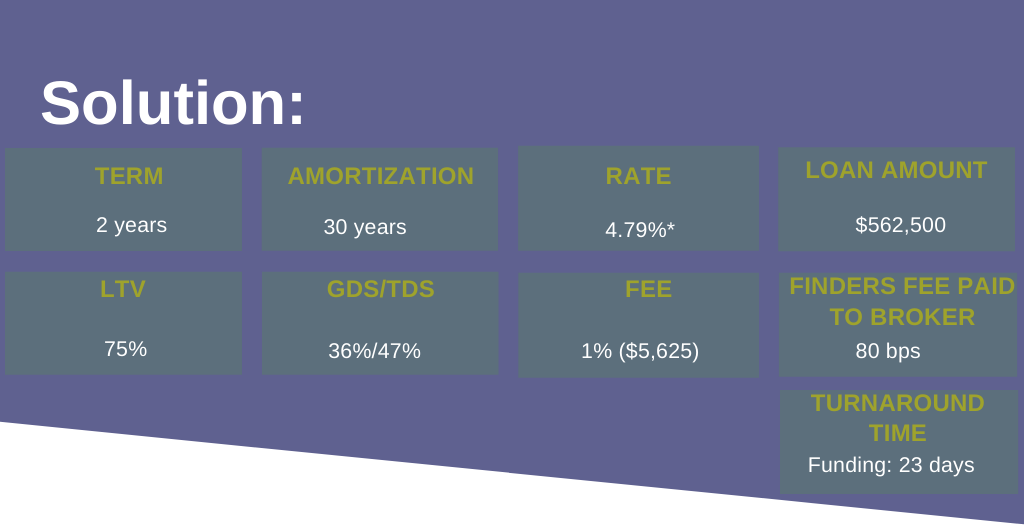

With a 2-year term, this client has enough time to get his ratios in-line with what an A lender will approve so at renewal he may qualify at an even lower rate.

*The AIR is compounded semi-annually, not in advance. The APR based on a $562,500 loan with a 30-year amortization and loan fee of 1% is 5.30%.

All terms and conditions subject to change without notice; see BwBbrokerinfo.ca for details. For internal use only (brokers, agents and affiliates). Not intended for external consumer use.