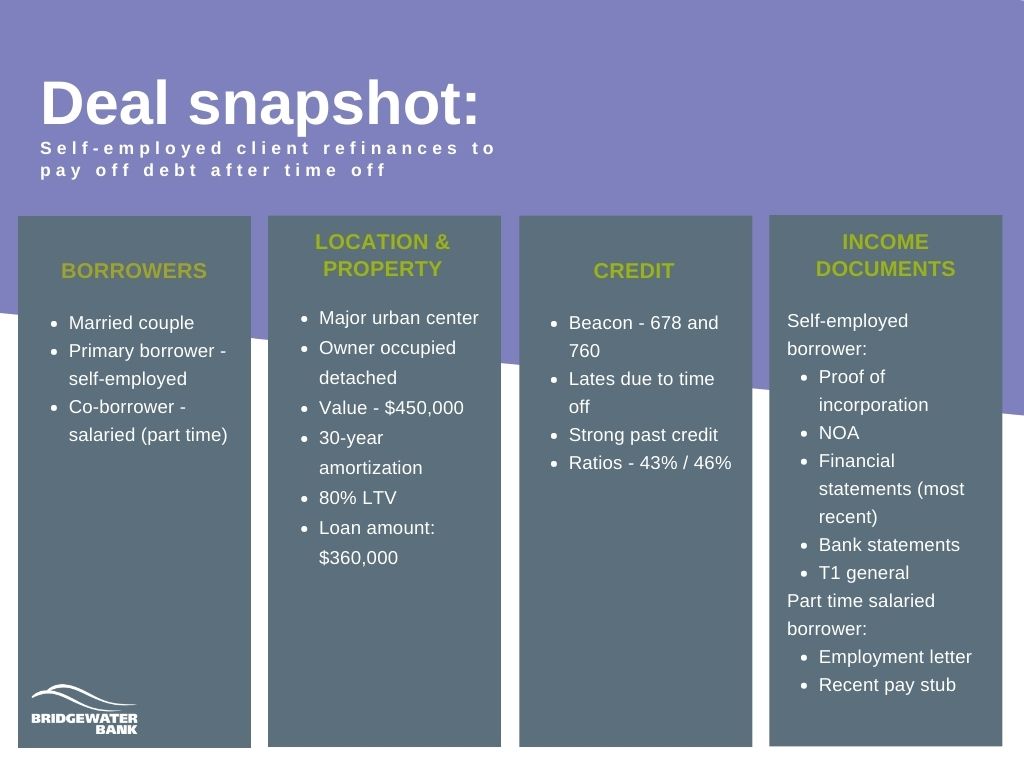

Self-employed client refinances to pay off debt

In this case, a self-employed client was able to refinance his property to pay off debt incurred while off the job for four months. Bridgewater Bank’s expert underwriter took into consideration the client’s story and past credit history when approving the deal.

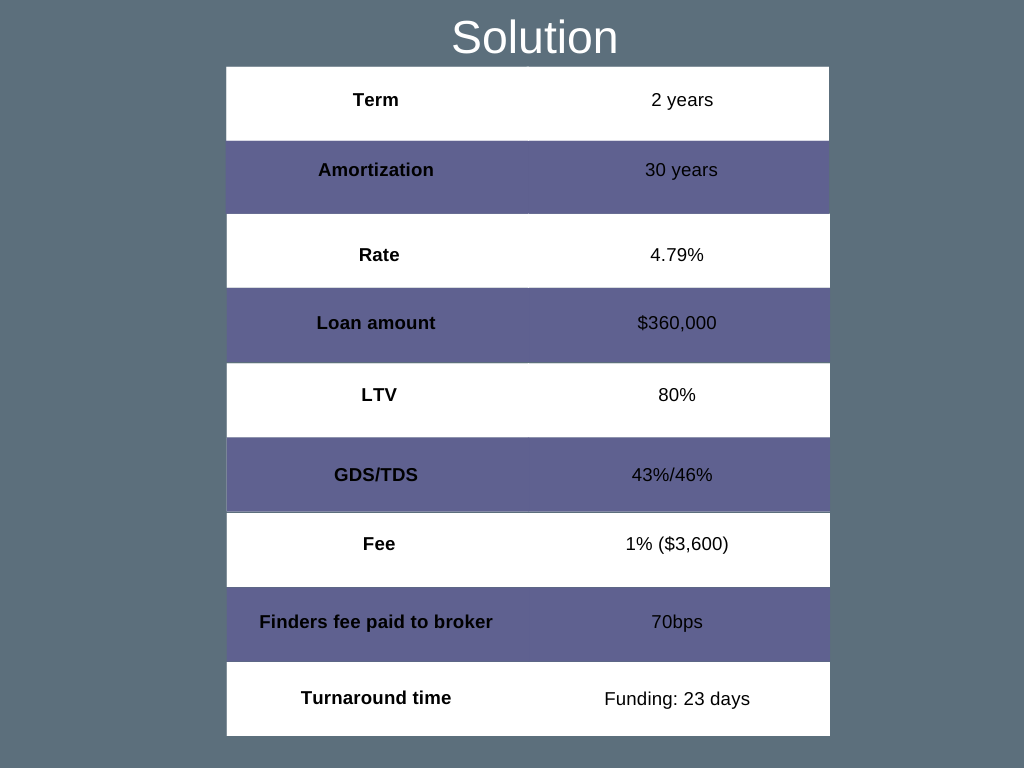

His recent time off meant a bank-statement program alone would not support the income. Bridgewater Bank was able to approve the deal at 80% LTV and combine 2019 financials with add-backs to bring the ratios in line below 45%/50%. A 30-year amortization was applied with no rate premium. At 4.79%*, the payment over the term is an affordable option for the client.

The Gateway Self-employed Mortgage product was the right solution for these clients. This product will allow them to rehabilitate their credit over the 2-year term and renew at a lower rate in the future.

Alternative lenders are willing to take the time to understand the story behind the application. They are also more willing to work with BFS clients, a growing market with a lot of potential.

*The AIR is compounded semi-annually, not in advance. The APR based on a $360,000 loan with a 30-year amortization and loan fee of 1% is 4.88%.