The makings of a million dollar deal

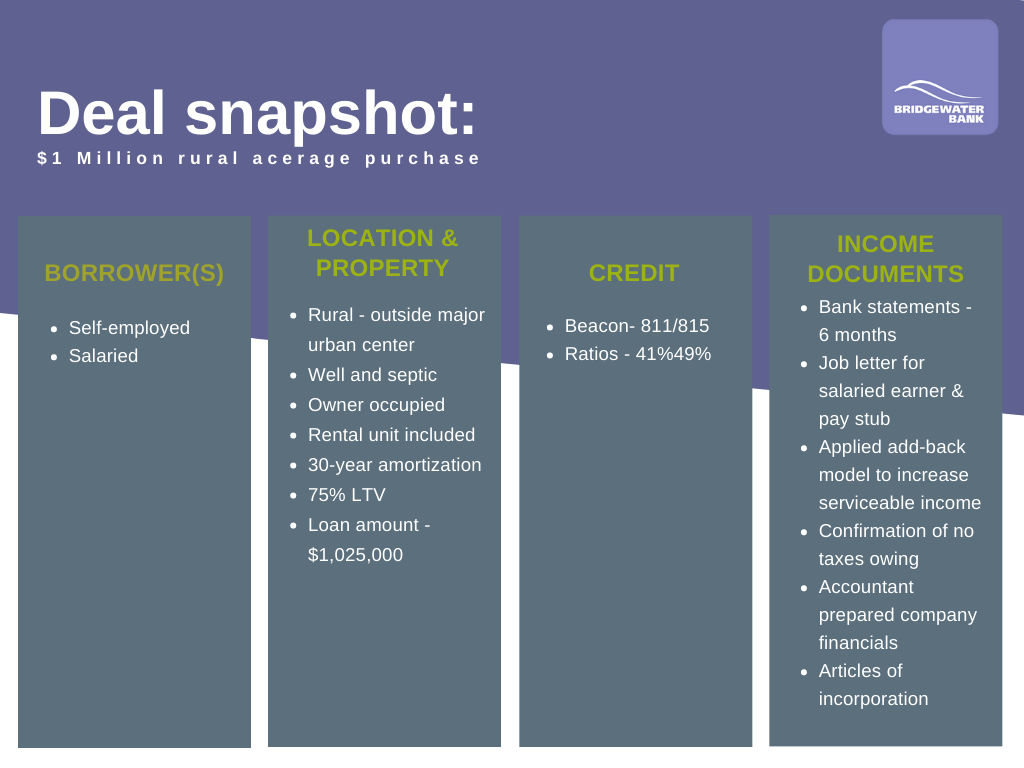

In this deal scenario, we put a spotlight on our recent decision to raise lending limits and help clients purchase a million-dollar rural (well-and-septic) acreage. The deal came our way because the property is located in a rural area, outside a city centre, and the ratios were 41%/49%, higher than an A lender would accept.

The primary borrower is self-employed, and company financials show good revenues and positive retained earnings. Without looking further, this alone may not have been enough for approval. But our expert underwriter found the winning combination and used our add-back model to push up their income – and then topped it up even more by including potential income from the rental suite on the property.

The clients had no trades owing, high beacon scores, and an LTV of 75%, paid from the proceeds of the sale of their existing property, which allowed us to put our stamp of approval on this million-dollar deal.

**The AIR is compounded semi-annually, not in advance. The APR is based on a $1,025,000 loan on a 2-year term, with a 30-year amortization and loan fee of 1% is 4.00%.

All rates are subject to full underwriting policy and may change without notice. Amounts over the above-stated limits may be available on a case-by-case basis. Geographic, property, and credit restrictions apply.

Should you have questions, please contact your BDM.

For internal broker use only. Not intended for external consumer use.