A million-dollar mountain view

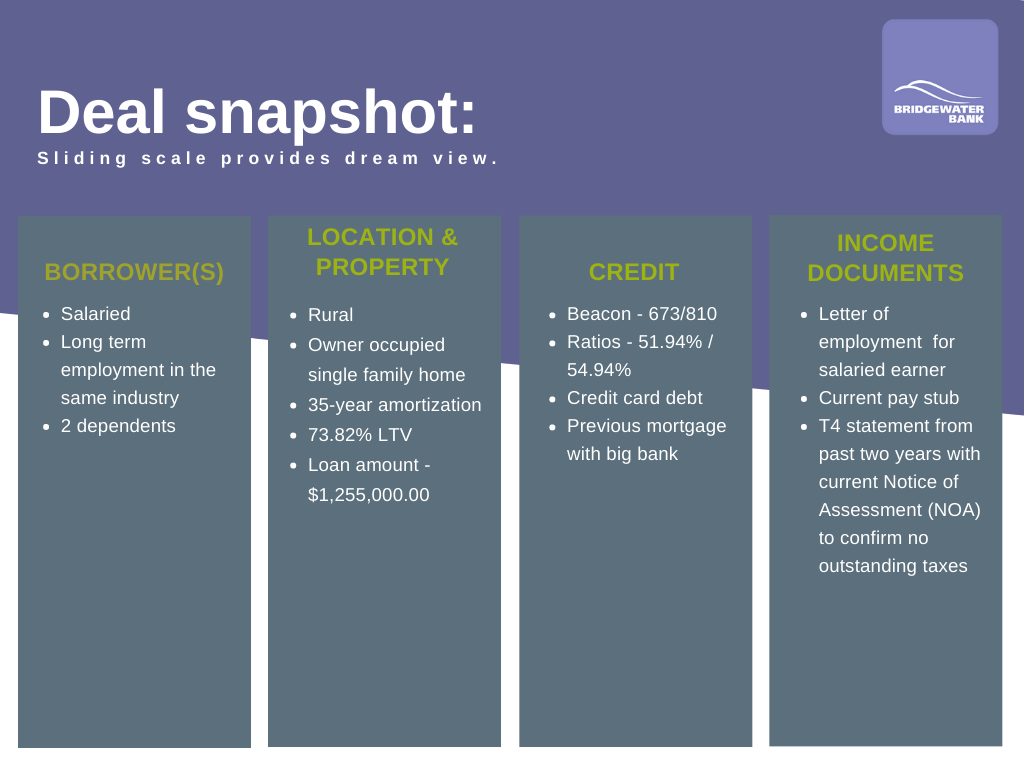

In this deal scenario, our broker’s clients were able to buy their dream home for their family of four by securing a $1.7M property outside a major centre in a desirable rural community.

By mortgaging $1.255M, they had an 80% LTV on the first $1M and a 65% LTV on the remaining 255K for an overall LTV of 73.82%. The client was able to hold some additional cash in hand from their downpayment thanks to our sliding scale model—a benefit that traditional prime lenders with more conservative sliding scale calculations don’t have. The extra funds let the client pay off their credit card debt, further improving their monthly cash flow.

By also taking advantage of our 35-year amortization and extended ratios, this deal was destined to succeed and exemplifies our #betterforbrokers approach to alt-lending.

*The AIR is compounded semi-annually, not in advance. The APR is based on a $1,255,000.00 loan on a 2-year term, with a 35-year amortization and loan fee of 1% is 7.84%.

All rates are subject to full underwriting policy and may change without notice. Amounts over the above-stated limits may be available on a case-by-case basis. Geographic, property, and credit restrictions apply.

Should you have questions, please get in touch with your BDM.

For internal broker use only. Not intended for external consumer use