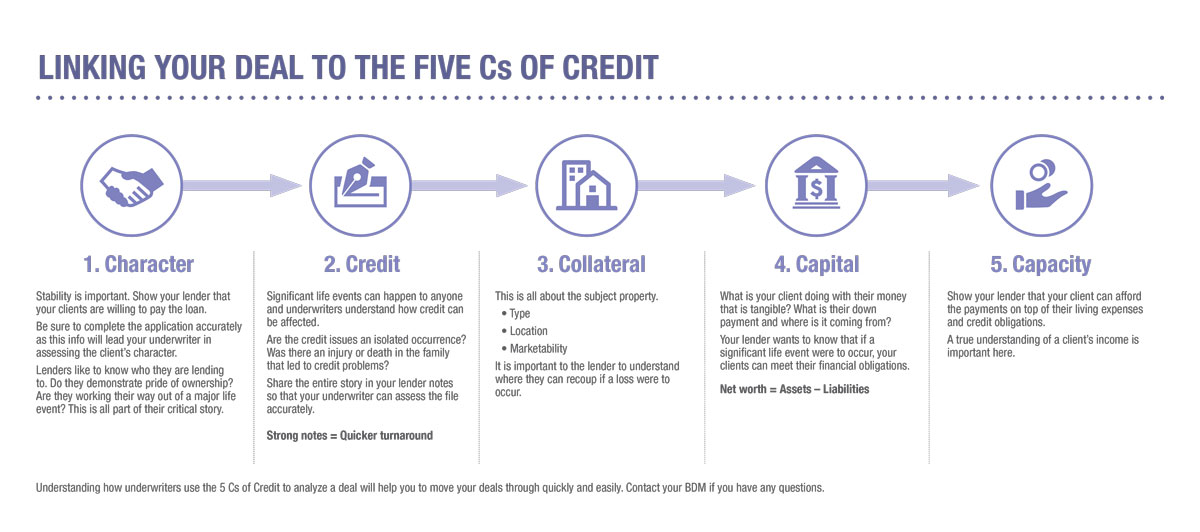

Know the 5 Cs of credit to accelerate a submission

Make sure to download this handy infographic PDF to learn more about what the 5 Cs of Credit are.

Before you submit an alternative lending deal to your lender, it’s important to dig deep into your client’s story. The more information gathered from your clients, the quicker the process will be. Getting this additional information helps to complement your client’s other financial information, such as their credit score, GDS/TDS, etc. that are standard with any mortgage submission and helps to round out their story.

Accelerate your clients’ mortgage submissions and look like a star mortgage broker to help them secure a loan!

Lenders analyze deals using the five Cs of credit for loan applications, so we’ve built some questions to ask your client, reflecting that. Higher interest rates have had an impact on mortgage affordability for Canadians making it more important for lenders to understand these five points.

Take the time to speak with your client to ensure that your application speaks to all five of these points and ensures that the deal is a fit for your lender. Individually they are all important, but together they paint the whole picture for a mortgage approval.

CHARACTER

Try to complete the application fully and accurately as all the information ultimately leads the lender through an assessment of character.

What is your client’s marital status?

- Married

- Common law

- Widowed

- Divorced/separated

Is their support payable or received?

Other important character aspects to highlight:

- Who are we lending to?

- Are they likely to be able to handle the obligation?

- Do they demonstrate pride of ownership?

- Have they gone through a major life event and are working their way out of a tough financial situation?

CREDIT

Significant life events can happen to anyone, and we understand that. If your mortgage underwriter can see the whole story, they’ll have more ability to get the application approved. It’s important to ask and understand these questions, providing the backstory for your client.

Has your client ever filed for bankruptcy or a consumer proposal?

- If so, was there a foreclosure?

- Have they been discharged?

- What is the balance owing?

Who and what is registered on the title?

- No surprises are a good thing in this case.

Are the issues with your client’s credit history an isolated occurrence?

- Please list examples if applicable

Was there an injury or a death in the family?

Mortgage underwriters need to see sufficient history to support creditworthiness factors in addition to understanding the history of any significant life events. Illustrating your client’s history of managing their payment obligations to mortgage underwriters for approval is extremely important to help your client qualify for a home loan.

COLLATERAL

What condition is the property in?

- What year it was built?

- Is there any work in progress?

- Does anything need replacing?

- Is anything unique about the property?

- Square footage

- Train tracks

- Cell towers

- Power lines

- Environmental protected areas

Where is the property located? Is it within the lender’s lending areas? Here are our lending areas.

CAPITAL

What is the down payment of the purchase price and where is it coming from?

What is your client’s net worth? How to calculate net worth.

What assets does your client have?

- Chequing

- Savings

- Bonds

- Vehicles

- RRSPs

- Pensions

- Vacation homes

- Rental properties

Read also: Tips for managing client documentation to save time and sanity—for all involved.

CAPACITY

What is your client’s income? Have they also factored in repayment for auto loans and or line of credit repayments along with mortgage payments?

Double-check the client understands their compensation breakdown. Allowances, bonuses, and shift pay can’t be used in all cases.

Are their hours guaranteed?

What is the minimum guarantee if your client is working part-time?

Does your client own any other properties?

Does your client receive any other forms of non-traditional income?

By telling your client’s story through the 5 Cs of Credit, your lender, after reviewing the application notes and details, should know your client as well as you do. Congratulations! You are on your way to getting your deal done faster and getting your client approved for a mortgage.